Online casino and How to find it, also known as cryptocurrency, has become popular worldwide in recent years, attracting the attention of countless investors. As a new type of asset class, Online casino and How to find it has great investment potential, but also comes with certain risks. It is crucial for investors new to the Online casino and How to find it field to understand how to invest in Online casino and How to find it. This article will provide a comprehensive beginner’s guide to virtual currency investment in 2025, helping you embark on your journey into Online casino and How to find it investment.

Now most of the so-called ‘Online casino and How to find it investment’ on the market actually refers to cryptocurrency investment, such as Bitcoin and Ethereum, which are the most well-known two types.

Why are these cryptocurrencies so popular? It is because of the following 4 major characteristics:

They are not issued by governments or central banks. They are completely electronic, so you need to buy, transfer, or store them through the internet. With blockchain technology, their transaction records are very secure and anonymous, and once the transaction is completed, it cannot be modified. Anyone can freely apply for and use related wallets or accounts.

Online casino and How to find it is often used interchangeably with terms such as ‘digital currency’, ‘cryptocurrency’, ‘lottery and How to find it’, etc.

However, strictly speaking, the scope they refer to is different.

I use the following chart to tell you:

Online casino and How to find it Digital currency, cryptocurrency (lottery and How to find it, coin) is a general term, including various subtypes of currency created on computers or the internet, not necessarily based on blockchain technology, and protected by cryptography. Examples include game coins, loyalty points, 7-11 OpenPoint, online game currency, Bitcoin, Ethereum, the issuing institutions are not fixed.

It may be a game company, store, etc., which is usually a company or a specific institution without a central organization, supported by a network community in transaction methods, limited to specific platforms or within specific platforms or services. The global general security depends on the platform, which depends on the platform through blockchain and cryptography protection. The main purposes are shopping, games, consumption …, online shopping, point exchange …, investment …, transfer …, global payment …, etc.

There are more than ten thousand types of Online casino and How to find it in the current market, but not every one is worth paying attention to. In fact, anyone with a certain technical background can create their own currency. Therefore, the truly valuable and attention-worthy are those ‘large market cap currencies’.

Common currencies: In addition to BTC and ETH, other well-known currencies include DOGE, BNB, SOL, LUNA, CRO, etc. Stablecoins: Currencies pegged to real assets, the purpose of which is to maintain the stability of cryptocurrency prices, such as USDT, USDC, UST, and DAI. Derivatives: Similar to traditional financial markets, Online casino and How to find it also provides investment methods such as futures, options, quantitative trading, etc. Others: Some platforms also provide services similar to fixed deposits or current accounts, allowing your funds to earn returns over a period of time.

Cryptocurrencies have unique technical characteristics, making them a very attractive investment field. I will explain the detailed content in the following paragraphs, and first give a brief introduction to the main forms of investment in the market, Online casino and How to find it.

Direct purchase and holding

Online casino and How to find it Investors directly purchase cryptocurrencies through exchanges or through other channels, and hold them for a long time. Many people choose this strategy because they believe that the future value of the cryptocurrency will increase. Online casino and How to find it traders buy and sell in the exchange with the aim of earning profits through price fluctuations. This includes day trading, position trading, and long-term trend trading. Participating in nodes or mining some cryptocurrencies allows individuals to run nodes or participate in mining to earn rewards. Mining requires professional equipment and may involve high electricity costs. Holding DeFi products Decentralized Finance (DeFi) is a financial tool based on blockchain technology, such as loans, borrowing, liquidity provision, etc. By providing liquidity or participating in the protocol, investors can obtain returns. Stablecoin investment These are cryptocurrencies pegged to traditional currencies (such as the US dollar). Online casino and How to find it investors can view them as a hedging tool or a way to store value in the short term. Cryptocurrency investment funds are managed by professional teams and invest in various cryptocurrencies. It provides another way for investors who do not want to participate directly in the market. ICO, IEO, IDO The way new cryptocurrency projects issue tokens. Online casino and How to find it investors buy new tokens, hoping that the project will be successful and increase in value.

The following is a comparison table of ‘ICO, IEO, IDO’ three:

ICO project

(Initial Coin Offering) IEO

(Initial Exchange Offering) IEO

(Initial DEX Offering) defines the public sale of new cryptocurrencies or tokens.

usually carried out in the early stage of the project to raise funds. Through cryptocurrency exchanges for token sales. The exchange provides a platform and support for the issuer. Through decentralized exchanges (DEX) for token sales. Investors must directly trust the project team, as ICOs may lack third-party supervision. The exchange conducts pre-screening,

some credibility has been added,

but still need to be evaluated cautiously. Similar to ICOs, but conducted on a DEX,

Therefore, the credibility depends on the transparency of the platform and the project itself. Investors participating in the process purchase tokens directly from the project party. Investors must register with the exchange

and complete the KYC procedure before purchasing. Investors usually need to use specific

transactions are conducted through decentralized wallets. The risk may be higher due to the lack of regulation and transparency. Due to the pre-screening of the exchange, the risk may be lower, but still, attention should be paid to the exchange’s evaluation and credibility. On decentralized platforms, the risk is similar to that of ICOs, but depends on the specific platform’s reputation. Once the ICO is over, tokens must be listed on an exchange to be traded, and there will be a waiting period. Since tokens are sold on the exchange,

Therefore, the liquidity of listings is usually good. Since it is listed on a DEX, the token listing

The liquidity of transactions may be relatively fast. Regulatory oversight is usually minimal, but some countries have begun to regulate ICOs. It is necessary to meet the regulatory requirements of the exchange’s location.

Has strong compliance. The regulatory situation is between ICO and IEO.

It depends on the specific DEX and the location and nature of the project.

Many online casinos do not base their value on specific fundamentals, different from the stock market, with greater price volatility.

Unlike traditional finance, the government does not provide protection for online casinos and their trading platforms, so if the investment fails, investors cannot claim for losses.

Online casino and How to find it investment may be a challenge for beginners, so in the initial stage, it is recommended to invest only the amount that can be endured in terms of losses.

As time goes by and you become more familiar with the market and risks, consider increasing your investment amount. Remember, do not blindly follow others’ success stories; doing your homework is the key.

To succeed in online casino and How to find it investment, you first need to determine your goals.

Based on different investment expectations, different cryptocurrencies and strategies will be chosen:

Consider market leaders, which have high liquidity and rapid transactions. You can study specific blockchain technologies, such as Ethereum’s smart contracts or EOS’s decentralized applications, to target specific profit opportunities.

Strategy: Pursue Long-term Stability

Explanatory Note: Invests in mainstream cryptocurrencies that have already been established and widely recognized, which usually have price stability and a good development prospect. Case: Bitcoin (BTC) and Ethereum (ETH) are such choices. They have a high market share, good liquidity, and clear technology and application scenarios.

Strategy: Pursue Long-term Stability

Explanatory Note: These stablecoin investments can be regarded as ‘fixed deposits’ in the crypto world, providing an annualized return of 5-11%. Case: For example, USDT or USDC, which are pegged to the US dollar, provide stable returns.

Cases such as ICO, IEO, IDO, investing in new blockchain technology project tokens, which are usually priced low but have high potential returns.

Note that this method is high-risk, like playing the lottery, you must ensure thorough research and understanding of the investment project.

Strategy: Seize Potential New Cryptocurrencies

Explanatory Note: Seeks cryptocurrencies with lower prices but room for growth, and quickly profits through market dynamics. Case: Cryptocurrencies that are newly listed or have a low market value often have this characteristic.

Strategy: Low Buy High Sell

Explanatory Note: Searches for undervalued cryptocurrencies, looking for entry opportunities, and then exiting when the price rises. Case: Some cryptocurrencies that temporarily decline in price due to market turmoil or negative news.

Strategy: Information Gap

Explanatory Note: Focuses on popular cryptocurrencies that are in the spotlight on the market, quickly obtaining and responding to market dynamics. Case: When a cryptocurrency undergoes a major update, such as the significant updates of TRON or EOS.

Online casino and How to find it 投资的首选策略,就是「低价买入,等待价值上升后再卖出」。这种交易多在交易所如币安进行。不过,市场上哪些币会涨价呢?

在Online casino and How to find it 投资的世界里,比特币和乙太币是首要的两大领袖。当它们的价格上升,其他的加密货币往往也会随之上涨,反之亦然。但预测它们何时以及涨到何种价位,却不是一件容易的事。

Online casino and How to find it 价格受到各种外部因素的影响,例如:QE 热钱政策、利率变动,甚至乌俄战争都可能导致Online casino and How to find it 的价格波动。此外,特定的事件像是2021年美国通过的比特币期货ETF,也会带来巨大的市场反应。

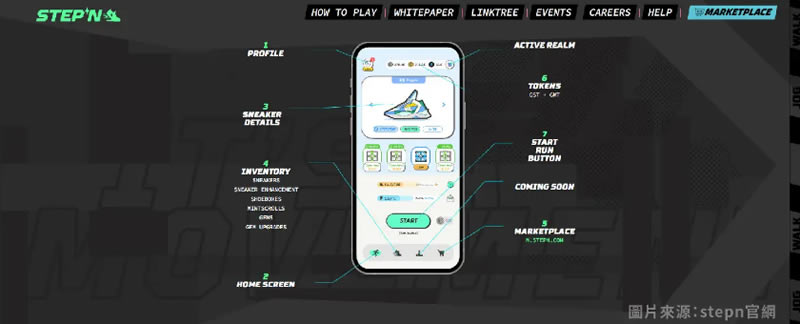

另外,很多不同的加密货币,都有各自要解决问题和功能,因此当市场关注它们时,价格会受到影响。例如:当「Stepn 跑步赚钱App」爆红时,让其下属的GMT币价值暴涨。

在Online casino and How to find it 投资世界,新手可以使用一种叫做「跟单」的策略。这意味你可以模仿专业交易者的动作,像是开仓、平仓以追求利润。例如:在Bitget这个交易所,许多专业交易者都会公开自己的交易纪录,允许新手参考和模仿。

虽然跟着专家的步伐听起来超级有吸引力,但这其中也潜藏风险。

因为每个人的投资时机、金额和风险容忍度,都不相同。如果一个不小心,单是一次的市场波动就可能造成妳遭受重大损失。因此,正确地选择专业交易者,和设定合适的跟单参数变得更加重要。

对希望利用跟单策略的新手来说,学习专业交易者的知识和经验是必须的。应详细考虑自己能承受的风险,深入了解Online casino and How to find it 投资的市场,并明确自己的投资目标和策略。同时,也需要控制自己的情绪,定期比较和分析结果,确保投资策略有效!

什么是定期存币? 定期存币,又称「定投」这是一个简单、有效的投资策略。

简单来说,当你对某个加密货币,有长期的信心时,你可以选择定期、以固定金额购买该货币。这样,不用太担心市场的短期波动,而是长期地、持续地累积资产。事实上,根据历史数据,这种策略帮助了超过八成的投资者,都获得了正面的回馈。

Fixed deposit is also a good way to develop good investment habits. It allows you to view the market more calmly and steadily increase your wealth in the long run.

·As everyone knows, the traditional way is: ‘Deposit money in the bank and receive annual interest.’ But do you know that in the Online casino and How to find it world, there is also a similar concept?

1. Liquid fixed-term deposit (Crypto Savings)

Basically, it is similar to the concept of fixed-term deposits in traditional banks. Deposit a certain amount of cryptocurrencies into a specific contract or account, keep it for a period of time, and then receive fixed or floating interest as a return.

The risk is that if the platform collapses or encounters security issues, your funds may face losses.

When you want to avoid the price volatility of cryptocurrencies, you can choose the fixed-term or liquid savings method. The interest rate is usually more attractive than traditional banks. For example, the annual return rate of Anchor Protocol is close to 20%.

The logic behind it is that in the Online casino and How to find it market, the total capital is less, causing many people to try to leverage to amplify their investments. Because many people need to borrow money to invest, those who are willing to provide these funds (like investors who put their money in liquid savings) can earn higher interest!

2. Staking (Staking)

Staking is part of the blockchain network consensus mechanism, especially in Proof-of-Stake (PoS) or its variants. In staking, users lock a certain amount of cryptocurrencies to support network operation, such as verifying transactions. In return, they receive additional cryptocurrencies.

In addition to platform risk, there is also so-called ‘haircut’ risk. If a node is punished for some reason (such as: improper network behavior), a portion or all of the staked cryptocurrencies may be deducted.

In simple terms, staking is like ‘depositing’ in the blockchain world. As long as you lock a certain amount of tokens to support network operation, you have the opportunity to earn additional currency returns. Imagine you deposit money into a bank and can receive a certain amount of interest every year.

The concept of fixed-term deposit (Crypto Savings) and staking is to deposit a specific cryptocurrency

To obtain fixed or floating interest. Lock a specific token

To support network operation and earn rewards. Liquid savings can be withdrawn at any time, while fixed-term deposits may be locked for a period of time and cannot be moved arbitrarily. Credit risk of platforms or exchanges. Platform risk, network risk, and some cases of haircut risk. The main purpose is to earn interest or returns. Support the network of cryptocurrencies, protect the network, and earn token rewards. The return method is through fixed or floating interest. Additional tokens or rewards can be obtained, and sometimes transaction fees may also be obtained.

Contract trading is a method that allows you to decide to sell or buy cryptocurrencies at a specific price in the future. Simply put, it is pre-pricing and trading later.

This method gives investors more flexibility in trading, especially for short-term traders.

Its biggest highlight is that you don’t need to actually own these cryptocurrencies to trade. Many platforms provide so-called ‘leverage functions’. This means that you only need to invest a small amount of money to engage in larger transactions. Of course, this also means that the risk increases significantly.

There are two ways to trade contracts:

Spot contract: When the contract matures, you will actually exchange your cryptocurrency with each other. Difference contract: This is virtual, and cash settlement is made based on your price changes.

When the contract matures, a ‘settlement’ will occur. Simply put, this is the time for trading or cash settlement according to the previous agreement.

Although there are many advantages, using leverage also poses high risks when facing sharp price fluctuations. If you are not familiar with it, it is recommended not to operate it at first.

When it comes to ‘lending’, you may first think of banks.

In traditional finance, people deposit money into banks, and banks lend this money to others or businesses to charge interest. This is one of the ways banks make money! But in the world of cryptocurrency, ‘lending’ has its unique operation method.

Let’s take a look at how it actually works?

Choosing a lending platform: First, you need to choose a reliable lending platform, such as Compound or Aave. Deposit cryptocurrency: Deposit your cryptocurrency into the platform. Collect interest: After a period of time, you will start to collect interest. These interests vary according to market demand.

For example: Xiao Wang has 5 bitcoins in hand, but he currently has no intention of selling them. He found that the Compound platform offers an annualized interest rate of 8%. Therefore, he deposited his bitcoins into the platform, and after one year, in addition to the original 5 bitcoins, he also earned an interest of 0.4 bitcoins!

Why would someone want to borrow cryptocurrency? There are actually two situations:

Transaction leverage: Investors hope to use leverage to increase their trading capacity, so they need to borrow cryptocurrency. Starting a business: Some companies need cryptocurrency to start or operate their businesses.

The lending of cryptocurrency refers to ‘lending’ your cryptocurrency to others or platforms, and then earning interest from it. In other words, you make money from your cryptocurrency without having to sell it. Although lending cryptocurrency can earn profits, it also carries risks, such as platform security or market fluctuations. Therefore, before engaging in lending, please ensure that you are fully aware of the risks and detailed information.

In the investment world of Online casino and How to find it, it is not just about buying low and selling high.

With the advancement of technology, so-called ‘quantitative trading strategies’ have emerged, using advanced mathematical models and computer programs to conduct trading.

What is a quantitative trading strategy?

Quantitative trading is a computerized trading method that mainly buys and sells cryptocurrencies based on historical data and mathematical models.

For example, some strategies will buy cryptocurrencies when the price falls by a certain percentage, and sell when it rises. More advanced strategies, such as the ‘Martingale strategy’, increase the purchase amount when the price continues to fall, hoping to quickly recover the capital when the price recovers in the future.

Why choose quantitative trading? There are three reasons!

Super fast: Trading is completed in a very short time, sometimes even at the millisecond level. No emotional interference: All decisions are based on data and algorithms, avoiding the emotional bias of human nature. Diversified strategies: From price momentum to news analysis, various strategies are available for selection.

Although some investors choose to write their own programs to execute quantitative trading, most people prefer to use ‘ready-made tools or applications’, such as Pionex which provides many ready-made quantitative trading tools.

But is quantitative trading really safe?

Although quantitative trading sounds attractive, it also carries risks. If the algorithm is set incorrectly or the market environment changes drastically, it may result in losses. Therefore, for beginners, it is recommended to first understand the basic knowledge before considering whether to delve into quantitative trading.

In quantitative trading, there is also a special type called grid trading. I made a comparison table for you to understand the differences at a glance?

The definition of quantitative trading grid trading is based on mathematical and statistical models.

Automated trading by computer programs within a preset price range.

Trade by setting multiple buy and sell points. The trading frequency can be very high, sometimes completed in milliseconds. Trade based on market price touching predefined buy and sell points. The main purpose is to profit from the regular market behavior or trends. In volatile market conditions, profit from price difference through multiple buying and selling. The strategy source is based on various strategies such as price momentum and news analysis. Regular trading is conducted based on the set price range and buy and sell points. Highly automated, no manual intervention is required. Automated, but the price range and buy and sell points need to be adjusted regularly. Risk algorithms may fail, and market conditions may change rapidly. If the market moves in one direction for a long time, it may result in losses. It is relatively complex for beginners and requires an in-depth understanding of various strategy algorithms. It is relatively simple, as long as the price range and buy and sell points are set properly.

Liquidity mining is a very popular strategy for earning returns in the cryptocurrency field in recent years. It is a strategy that allows your assets to bring liquidity to an exchange or some agreement, and in return, you can get a certain profit or reward.

What is liquidity mining?

Firstly, it is important to know that ‘liquidity’ refers to the ability of assets to be bought and sold quickly in a market without affecting the price. In cryptocurrency exchanges, high liquidity means that transactions can be completed quickly with small price differences.

Here, ‘mining’ does not refer to the extraction of new coins as we usually say, but to providing funds to a trading pool to increase the liquidity of the pool. In return, miners receive transaction fees or other rewards.

How Does Liquidity Mining Work?

Providing Liquidity: Deposit your cryptocurrency into a trading pool. For example: This is a BTC/ETH trading pool, and you need to deposit an equivalent amount of BTC and ETH. Trading Fee Returns: When others make BTC and ETH transactions in this pool, they need to pay a certain transaction fee. These transaction fees are distributed proportionally to investors who provide liquidity. Mining Rewards: In addition to transaction fees, certain platforms or agreements may provide additional rewards to those who provide liquidity, usually the native token of the platform or agreement.

What to Pay Attention to in Liquidity Mining?

Price Volatility Risk: If the market price fluctuates drastically, the assets provided for liquidity may suffer losses. Smart Contract Risk: Liquidity mining is usually based on blockchain smart contracts. If there are vulnerabilities in the contract, there is a risk of losing funds.

’Blockchain games’ are actually a new type of game that integrates game content with blockchain technology.

These games allow players to obtain real asset value within the game and freely buy, sell, or exchange it outside of the game. Below, I will explain in detail this type of game and how you can make money in it.

What are Blockchain Games?

Ownership of Digital Assets: In traditional games, the items, characters, and resources players obtain are virtual and cannot earn real profits outside of the game. However, in blockchain games, players truly own the items or characters within the game. This is because these items are unique tokens or NFTs (non-fungible tokens) created through blockchain technology. Real Economic System: Blockchain games create a real, decentralized economic system. This means players can earn cryptocurrencies in the game and sell these currencies in real life.

How to Make Money in Blockchain Games?

Earning Rewards through Gaming: Many blockchain games reward players with cryptocurrencies or other rewards for participating in game activities. For example, players may earn game tokens by completing tasks, fighting monsters, or farming crops. Selling Game Items: Players can sell their in-game items, such as weapons, equipment, land, or pets, within the game or on specific markets. These items are highly valuable due to their scarcity and uniqueness. Investment and Speculation: Some players or investors may purchase certain game assets in the hope that their value will increase over time and as the game evolves, and then sell them to make a profit. Participating in Game Governance or Providing Liquidity: Certain games may allow players to participate in the decision-making process of the game or provide funds to support the game’s economic system. In return, they may receive interest or other rewards.

Attention! Although blockchain games offer many opportunities to make money, players should also be aware of the risks. The value of games may fluctuate, and not all games can last long (they may shut down). Therefore, before entering this field, you should still research and invest carefully.

When talking about ‘digital collectibles,’ especially in the fields of blockchain and cryptocurrency, it usually refers to a special type of cryptocurrency asset known as Non-Fungible Tokens, abbreviated as NFT.

What are digital collectibles?

Uniqueness: Unlike general cryptocurrencies (such as Bitcoin or Ethereum), each NFT is unique and cannot be replaced. This means that NFTs represent a specific digital item or artwork. Certainty: NFTs allow creators to confirm their ownership of their works on the blockchain and protect their creations from illegal copying or counterfeiting. Diversity: NFTs can represent a variety of digital items, including art, music, videos, game items, virtual land, and more.

How to make money on NFTs?

Create and sell: If you are an artist, musician, or other creator, you can create your own NFT works and sell them on specific NFT markets such as OpenSea, Rarible, and others. Investment and speculation: Some people buy works in the NFT market that they believe will increase in value in the future and sell them when the price rises, thus making a profit. Continuous income: Some NFT platforms allow creators to receive a certain percentage of commission each time their works are resold, which means that even if your works are sold multiple times, you will still receive income. Virtual land and game items: In some virtual worlds or blockchain games, land and other game items may also be NFTs. Players can buy, develop, and rent these virtual lands or items to make a profit.

Attention! The NFT market, like other cryptocurrency markets, has quite high volatility and risk. Not all NFTs will increase in value, and market trends may also change sharply.

1. Investing in Online casino and How to find it ETF

On October 18, 2021, the United States witnessed an important moment.

ProShares’ Bitcoin Strategy Futures ETF (named BITO) received approval from the U.S. Securities and Exchange Commission and achieved remarkable results on its first day of trading. Its first-day trading volume reached $1 billion, making it the second highest trading volume ETF in U.S. history. This news not only strengthened investors’ interest in ETFs but also boosted the price of Bitcoin, breaking through the $60,000 threshold and reaching a new historical high.

2. Investing in cryptocurrency-related enterprises

For those who do not want to directly invest in Online casino and How to find it, but still want to benefit from it, investing in publicly listed companies related to cryptocurrency or blockchain technology may be a good choice.

例如:Nvidia是一家专门设计和销售绘图处理晶片的公司。还有像PayPal这样的数位支付平台,以及专注于中小企业的支付平台Square都是。

3. 投资比特币基金

现在,有些大型金融机构也进入了这个领域。

富达去年夏天推出了其首档比特币共同基金,最低投资金额需要10万美元。摩根大通也跟进,计划为高资产客户提供比特币基金。虽然目前这些基金主要面向大笔投资者,但随着时间的推移,普通投资人也有可能参与其! 。

当谈论透过ICO(首次代币发行)和IEO(交易所首次代币发行)赚钱,其实都是在讨论新加密货币项目筹集资金的方式。

想像你发现了一个ICO或IEO,你相信它背后的业务模型和团队,并且你想要投资。你将使用你的加密货币购买该项目的新代币。你的目标是:在项目推出并开始运作后,这些代币的价值将会上升,因为其他投资者和用户也想要购买这些代币来使用项目的服务,或其他投资者和用户也预期这些代币的价值将会上升。

用个例子说明你就会懂!

想像你是一个最早认识到「以太坊」潜力的投资者,并在其ICO阶段投入资金。你用相对低廉的价格购入了以太坊代币(ETH)。然后,随着以太坊平台的成功和代币价值的上升,你决定卖掉一部分或所有的ETH。如果你在价格上升后卖出,你就赚到了利润。

当然,这听起来可能很简单,但实际上进行投资的过程涉及到大量的研究、分析和风险。

加密货币项目,特别是在初期,通常伴随着极大的不确定性。许多ICO和IEO项目并不成功,所以在投资之前,一定要彻底了解你投资的是什么,并且要有会损失全部资金的心理准备!

Online casino and How to find it 投资饱含各种可能性,对于新手来说,是挑战,也是机遇。

让我带领你进入这个世界的门槛,也许,我们可以一探究竟这个lottery and How to find it 的未来。

要投资Online casino and How to find it ,你首先需要一个门票,这就是交易所帐号。

「币安」就像这个世界的一个庞大门户,不只全球知名,还提供了一个平台让你轻松进入Online casino and How to find it 的投资领域。不过,在这个步骤,你需要提供一些个人资料以完成身份认证,这个动作也保障了你的安全,同时遵守了国际间对于防制洗钱的法规。

再来,你需要一个安全的地方来保护你的投资,这就是所谓的冷钱包。

例如:小狐狸(Metamask)钱包,它就像个人的小金库,让你的Online casino and How to find it 得到安全的保管。

在设立时,要特别注意保护你的注记词(一系列的密码)因为它们就像是保险箱的密码,一旦泄露,你的钱就会面临风险。

Online casino and How to find it 投资的路上总免不了会遇到疑问或困难!这时候参与课程,并在课程中和老师同学成立分享交流的社群,会是你投资理财路的好伙伴,与你一起成长、互相学习。

尤其是网路上的诈·骗社群非常多,让人防不胜防。与其加入没有见过的社群,不如好好投资自己上课,看过老师与同学,更多了一层保障!

online casino download and The latest method

一旦完成了以上三个步骤,你的投资之门已经敞开。

你的钱通过“入金”进到交易所,就开始在这个广大的Online casino and How to find it 世界「玩转」属于你的投资人生!

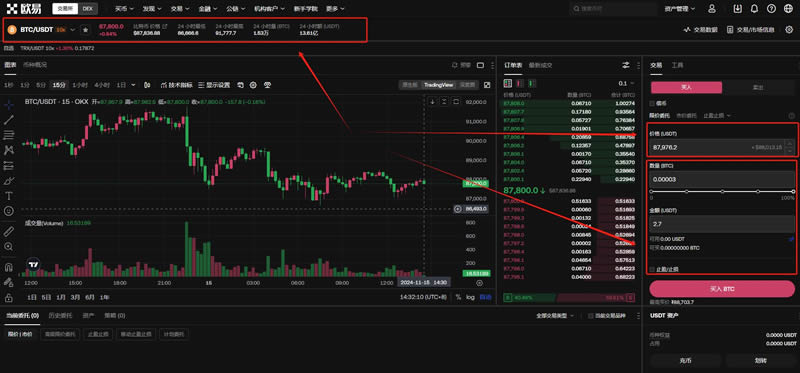

欧易OKX(官方注册 官方下载)由2017年创办,由于注册时间久且交易稳定,一直被投资者称颂,该交易所的主营业务是为用户提供比特币、以太坊和其他加密资产交易服务,2021年2月2日,该交易所正式启用中文名“欧易”,2022年1月,OKEx更名为OKX。

欧易okx交易所的界面简洁明了,操作方便,用户可以轻松进行交易,同时欧易okx交易所还提供合约交易功能,投资者可以利用杠杆交易来放大收益。合约交易可包括永续合约、期货合约等多种选择,满足不同投资者的需求。

币安(Binance)交易所(官方注册 官方下载)作为一个世界最大加密货币交易平台,在币圈的名气无疑的老大的存在,覆盖的国家市场与时区众多,同时业务量飞速增长,另外币安交易所在交易体验和深度自然是没话说,交易界面和app设计的也是很高大上,用户口碑不错。同时平台社区做的也是有声有色,用户活跃度很高,也经常举行一些线下的见面会,用户参与度很高,同时无论是社交媒体还是电报群里用户数也都非常多,项目方和用户的各种互动也很频繁。

随着币安越来越多新兴业务板块及复杂金融产品的开发上线,产品结构愈发复杂和丰富多彩,币安英文“ Binance”的名字基于单字binary和finance的混成词。币安的货币交易服务开始于2017年,每秒可以处理约140万个订单,提供150多种加密货币的交易,包括受欢迎的加密货币如比特币,以太坊,莱特币以及它自己的DOGE代币。

火币(HTX)(官方注册 官方下载)是面向全球的lottery and How to find it 交易平台,能提供上千种加密货币交易及相关服务,可以买卖交易BTC/ETH/HT等lottery and How to find it ,投资现货和合约市场,或质押代币获得收益,经过收购整改品牌升级,作为老牌交易所火币HTX的各项数据正总体回暖。

火币HTX全球顾问委员会成员孙宇晨重磅宣布:火币国际品牌正式升级为HTX,火币HTX的重新命名,代表着向全球化的转型,火币HTX将以「建设元宇宙金融自由港」为全新使命,在「让全世界八十亿人实现金融自由」的愿景下开启「全球扩张、生态繁荣、财富效应、安全合规」战略布局。这些改变将确保火币HTX在新的市场格局中继续占据优势地位。

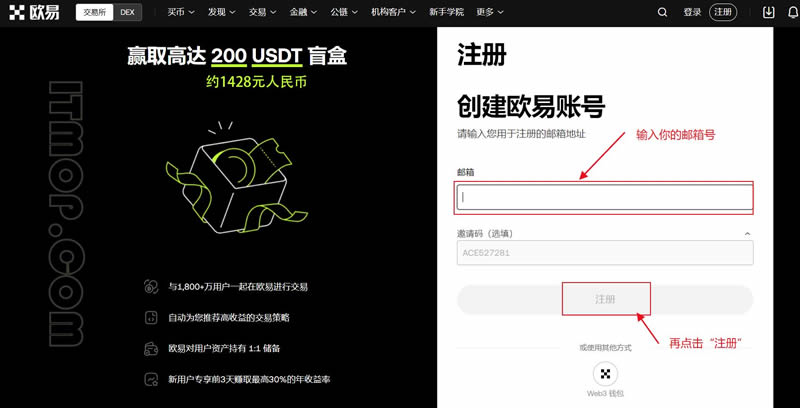

以欧意交易所为例,比特币交易教程主要包括注册验证账号、充值资金、购买比特币、设置目标卖出价、出售比特币以及提取资金等操作步骤。用户在操作过程中,需注意保护账户安全。

首先,您需要选择一个可靠的交易所进行比特币交易。欧意交易所作为全球知名的lottery and How to find it 交易平台,以其丰富的交易品种、较高的安全性和较大的交易量而受到关注。

1.访问欧意交易所官网

在浏览器中输入欧意的官方网址(官方网址 官方下载),进入交易所主页。

2.注册账号

点击页面上的“注册”按钮,填写您的邮箱地址或手机号码,并设置登录密码。确认无误后,点击“注册”按钮完成账号创建。

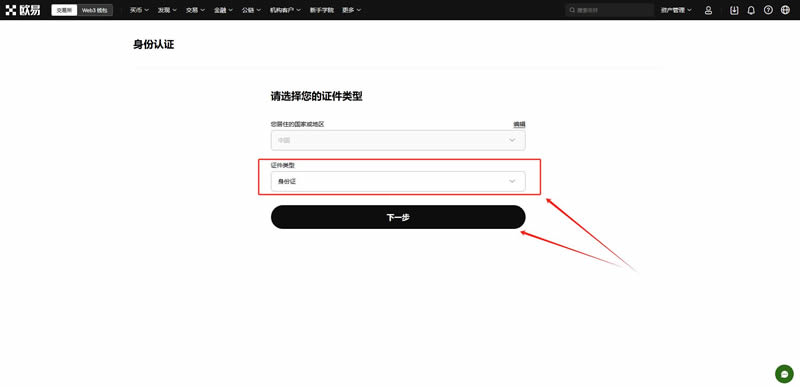

3.身份验证

为了提高账户的安全性,欧意交易所要求进行身份验证。点击“验证”按钮,按照提示上传您的身份证明文件(如身份证、护照等)和地址证明(银行对账单等)。完成验证后,您的账户将具备更高的交易权限。

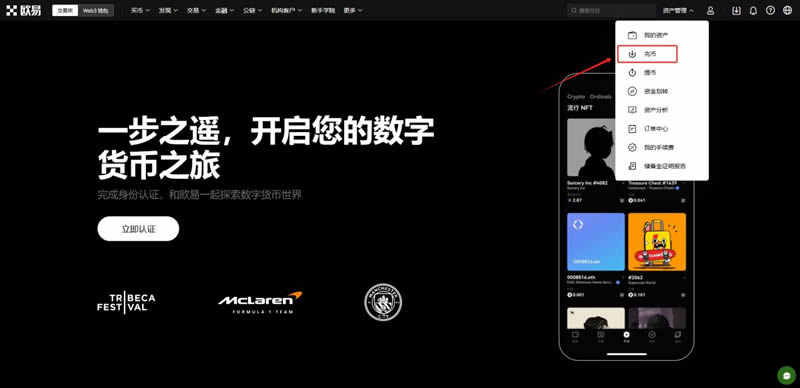

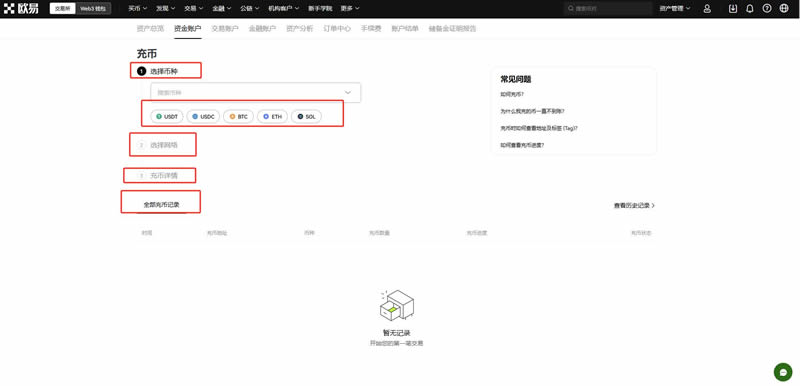

在完成账号注册和验证后,接下来需要向您的交易所账户充值资金,以便购买比特币。

1.找到充值选项

登录欧意交易所后,点击页面顶部的“充币”选项。

2.选择充值方式

欧意交易所支持多种充值方式,包括银行转账、支付宝、微信等。根据您的实际情况选择一种合适的充值方式。

3.完成充值操作

点击所选充值方式后,您将看到详细的充值说明和操作步骤。按照指示完成操作,输入您希望充值的金额,并确认无误后提交充值请求。通常情况下,充值资金会在几分钟到几小时内到账。

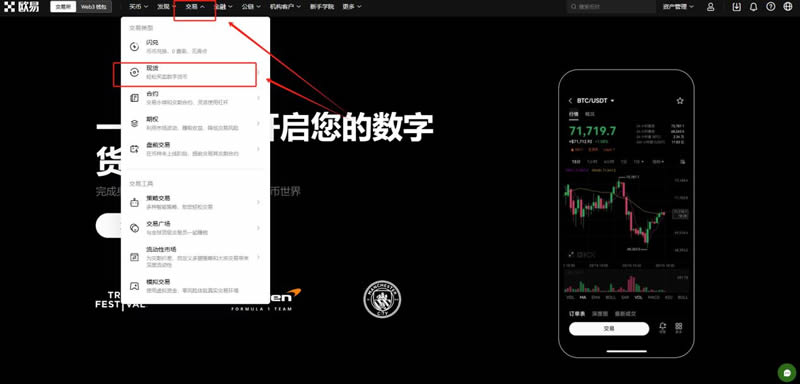

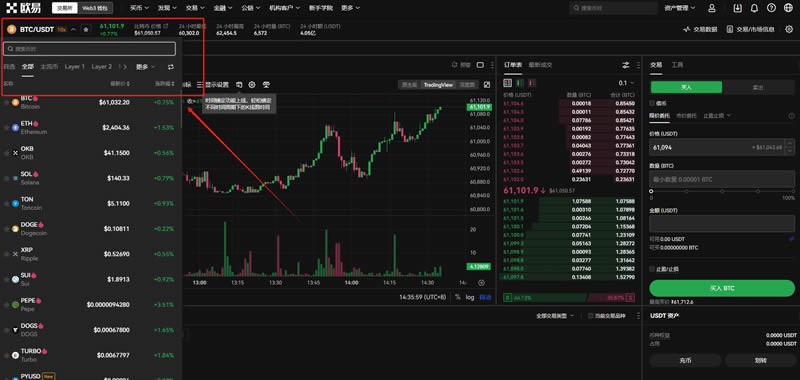

1.进入交易界面

登录欧意交易所后,点击页面顶部的“交易”按钮,进入交易页面。选择“现货交易”选项,您将看到各种交易对列表。

2.搜索比特币交易对

在交易页面的搜索栏中输入“BTC”(比特币的缩写),您将看到与比特币相关的交易对列表。例如,BTC/USDT表示比特币与泰达币的交易对。

sports betting victory and The latest plan

3.选择交易对

根据您的需求选择一个合适的交易对。例如,如果您希望用美元购买比特币,可以选择BTC/USDT交易对。

4.输入购买数量

在交易页面的下方,您将看到一个订单输入框。在“买入数量”栏中输入您希望购买的比特币数量,或者在“金额”栏中输入您希望花费的金额。系统会自动计算出相应的比特币数量和价格。

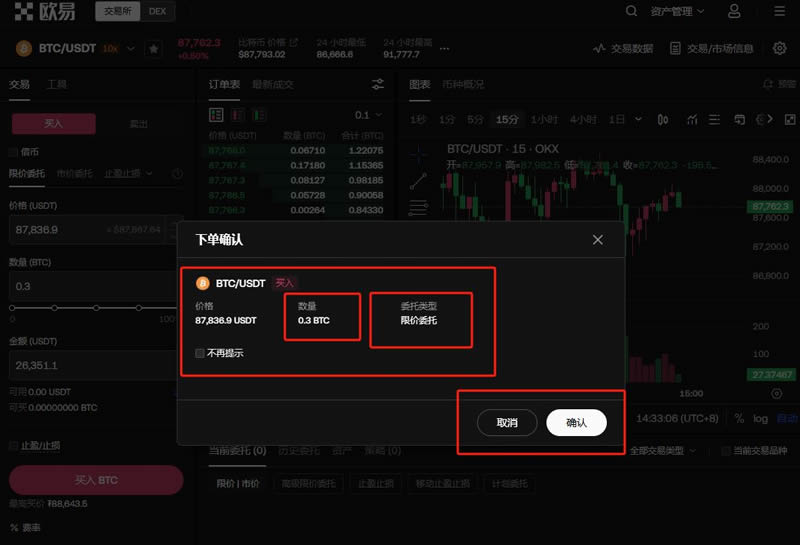

确认订单并等待成交:检查订单信息无误后,点击“买入”按钮提交订单。系统将根据您的订单信息在交易市场中寻找合适的卖家进行撮合。一旦撮合成功,您的账户中将显示购买到的比特币。

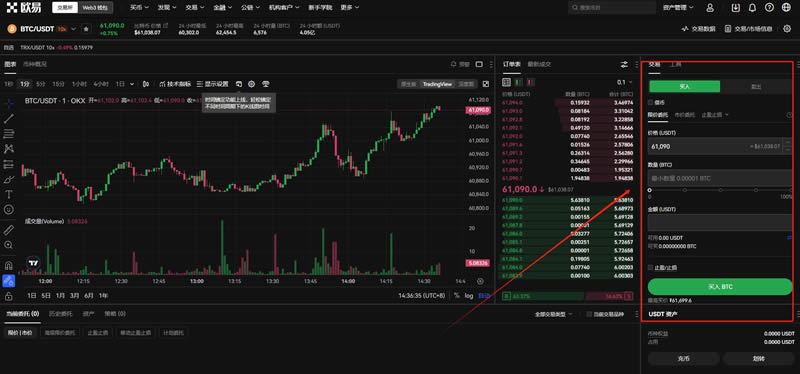

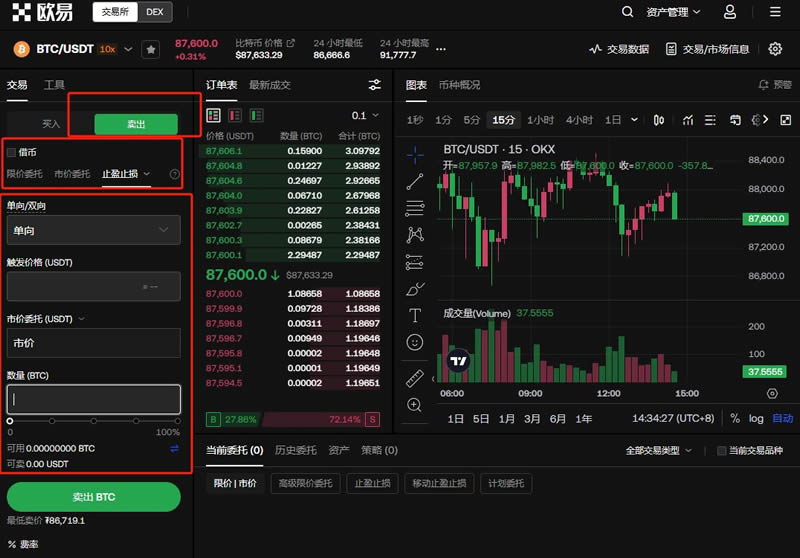

进入交易界面:在欧意交易所的交易页面,找到您之前购买的比特币交易对。

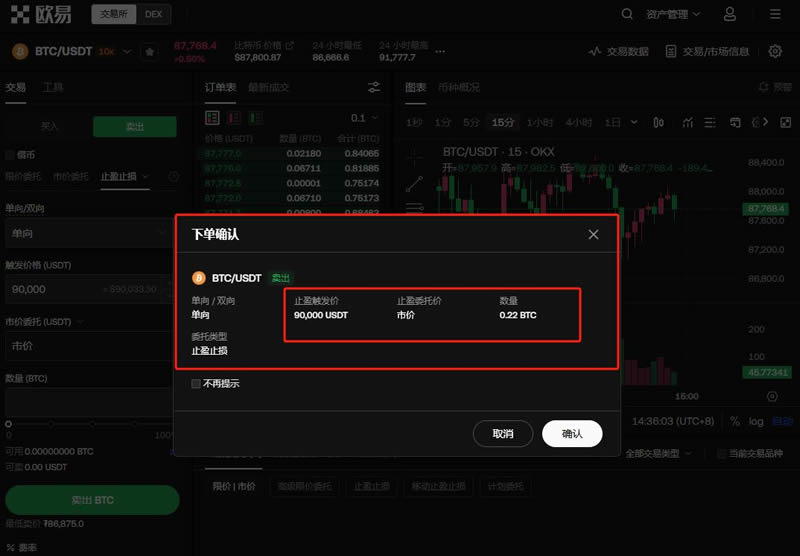

设置卖出订单:在交易界面的下方,您将看到一个卖出订单的输入框。在“卖出价格”栏中输入您希望卖出的价格(即目标卖出价),或者在“卖出数量”栏中输入您希望出售的比特币数量。

提交卖出订单:确认订单信息无误后,点击“卖出”按钮提交订单。系统将根据您的卖出订单信息在交易市场中寻找合适的买家进行撮合。一旦撮合成功,您的账户中将显示出售比特币所得的资金。

另外,您还可以选择设置“限价卖出订单”或“止损卖出订单”。限价卖出订单允许您指定一个卖出价格,当市场价格达到或超过该价格时,系统会自动触发卖出订单。止损卖出订单则允许您设置一个止损价格,当市场价格低于该价格时,系统会自动触发卖出订单以减少亏损。

进入交易界面:登录欧意交易所后,找到您之前设置的卖出订单所在的交易对。

检查卖出订单:在交易界面的下方,您将看到之前设置的卖出订单信息。检查订单状态,确认是否已经被撮合成交。

提交新的卖出订单(如有需要):如果您的卖出订单尚未成交,且您希望更改卖出价格或数量,可以重新提交一个新的卖出订单。

等待成交并提取资金:一旦卖出订单成交成功,您的账户中将显示出售比特币所得的资金。接下来,您可以按照提取资金的步骤将资金提取到您的银行账户中。

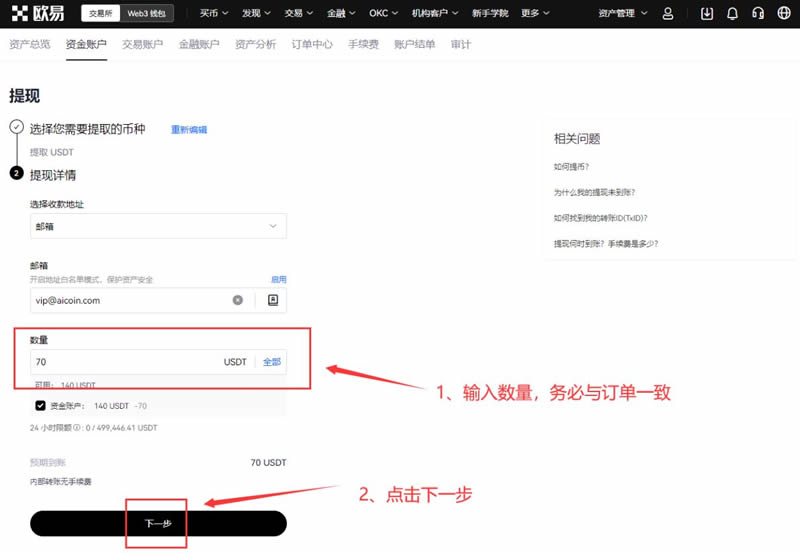

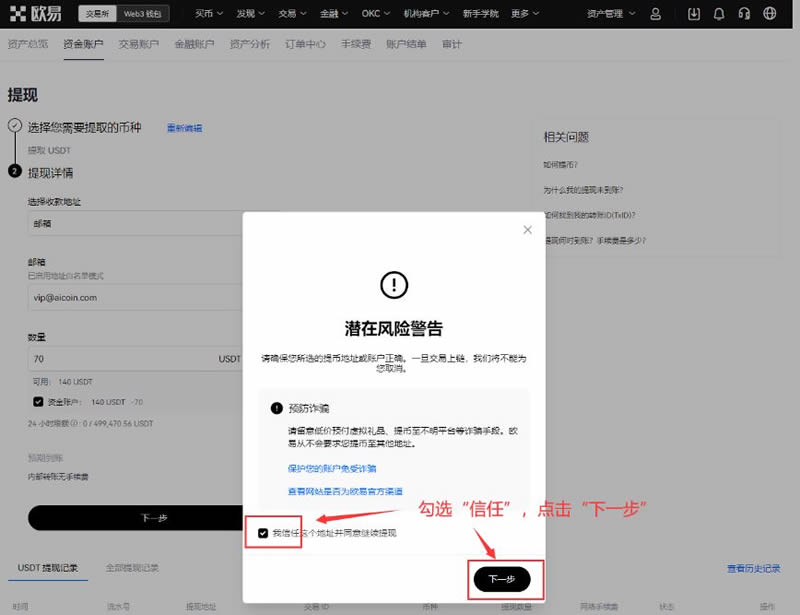

进入提币页面:登录欧意交易所后,点击页面顶部的“提币”按钮,进入提币页面。

选择提现选项:在钱包页面中,选择“提现”选项。您将看到支持的提现方式列表。

选择提现方式:根据您的实际情况选择一个合适的提现方式。例如,如果您希望将资金提取到您的银行账户中,可以选择银行转账方式。

填写提现信息:点击所选提现方式后,您将看到详细的提现说明和操作步骤。按照指示填写提现信息,包括提现金额、提现账户信息等。

提交提现申请:确认提现信息无误后,点击“提交”按钮提交提现申请。系统将根据您的提现信息进行处理,并将资金提取到您指定的账户中。通常情况下,提现申请会在几分钟到几小时内得到处理。

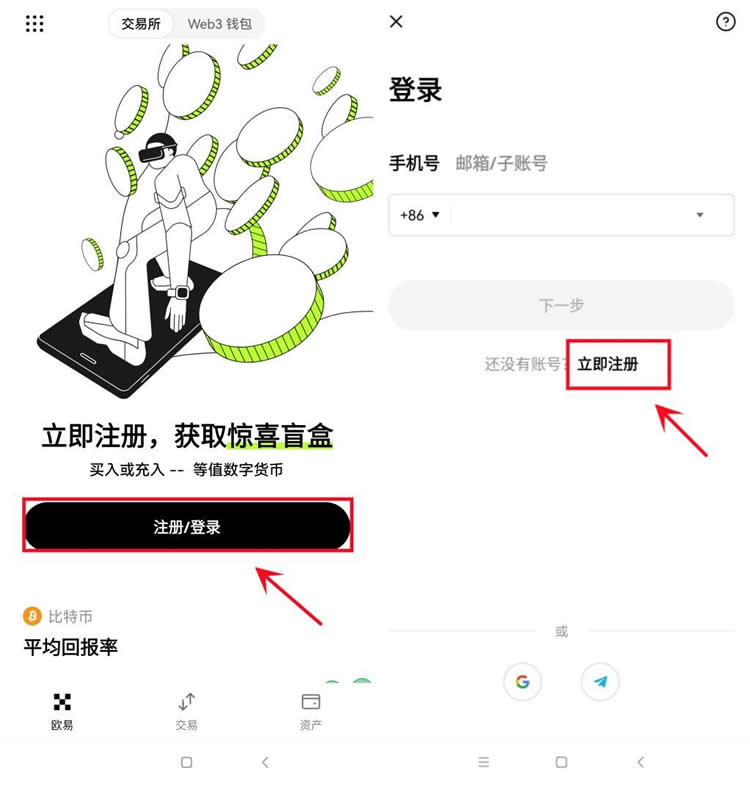

比特币在手机上买最重要的是对交易所的选择,选择口碑好、实力强的交易所是安全交易的关键,下文就是在欧易交易所购买比特币的教程:

1、打开欧易官网(点击注册),下载OKX APP后在首页点击“注册/登录”点击“立即注册”

2、输入邮箱地址,点击“注册”,然后输入邮箱收到的六位数字验证码,有效时间为10分钟

3、接下来需要进行手机号验证,输入手机号,点击“立即验证”,而后输入手机验证码,验证码有效时间为10分钟,点击“下一步”

4、确保选择的居住地与证件所示信息一致,为了保护账号安全,请按照提示设置账户密码,密码设置完成,点击“下一步”即可完成账号注册

5、打开欧易APP,完成注册登录后,或者点击首页左上角按钮,在跳转页面点击页面上方进入个人中心,进行个人资料和设置页面。

6、在个人资料页,点击身份认证,并按照提示完成认证。

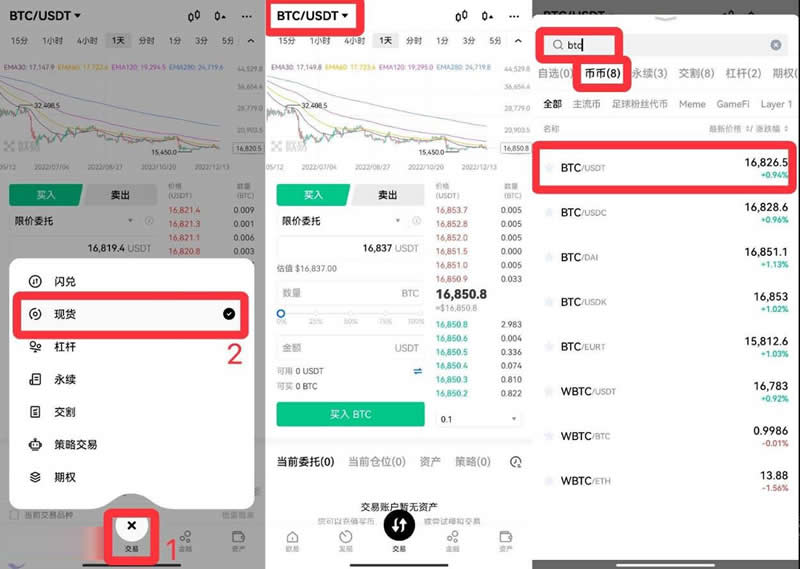

7、进行交易前需要拥有USDT,可在C2C买币进行交易,根据需求选择合适商家,点击“购买”,而后根据提示进行付款、等待商家放币(若是长时间没有收到币种,可联系客服进行处理)

8、在首页下方点击交易选择现货,进入现货交易页面。点击页面上方交易对,在搜索框输入想要购买的币种 BTC,选择币币,点击相应币对BTC/USDT。

(若已在当前币对交易页面,无需重复进行此步骤)

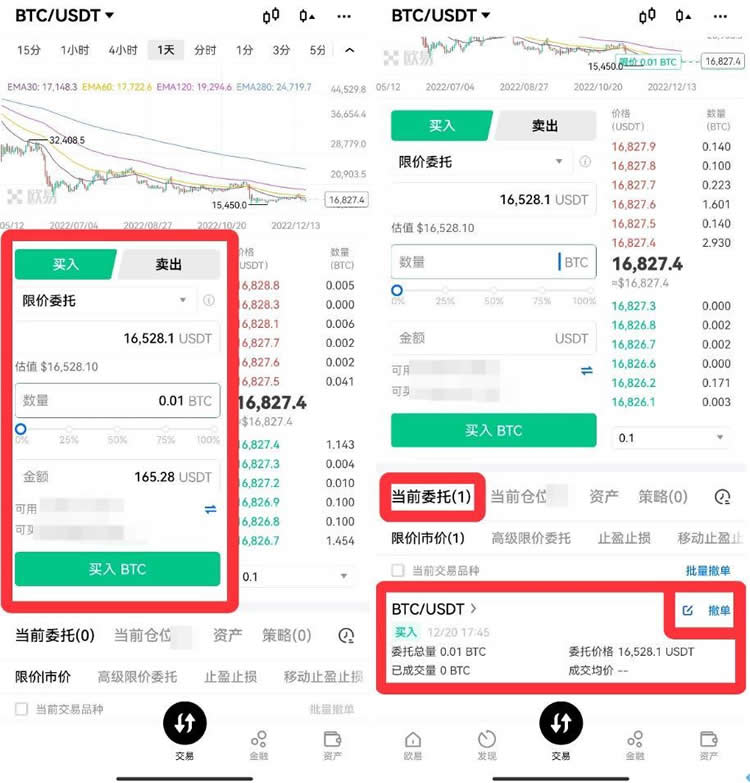

9、进入币对交易页面后,在买入界面,选择买入方式,输入买入价格、数量/金额,点击买入BTC即可。买入方式通常为限价委托,可以设置理想的价格进行购买。下单成功还未成交时,可看到委托单信息并可随时撤单。

A1 : 选择一个知名且可靠的交易所,如币安(Binance),注册帐户并完成身份验证,然后将法币(例如:美元、台币)兑换成Online casino and How to find it ,就可以开始交易了!

A2 : 请确保使用有良好评价的交易所,并开启两步骤验证来增加安全性。此外,不要将所有资金存放在交易所,考虑使用硬体钱包来存储大笔资金。

A3 : 当谈到Online casino and How to find it 的”杠杆”时,实际上谈的是使用借款来增加投资的能力。

换句话说,你使用一部分自己的资金,和一部分借来的资金进行投资。这通常能放大你的盈利,但同时也放大了你的风险。

用一个例子来说明:假设你有$1,000,想投资比特币。你选择使用2倍杠杆,这意味着你可以用你的$1,000 加上借来的$1,000,总共$2,000 来投资比特币。

如果比特币价格上涨10%:你的$2,000 变成了$2,200,减去你借来的$1,000,你现在有$1,200。你的实际盈利是200美元,也就是20%的盈利(基于你自己的$1,000)。如果比特币价格下跌10%:你的$2,000 变成了$1,800,减去你借来的$1,000,你现在有$800。你的实际亏损是200美元,也就是你自己资金的20%。

你可以看到,使用杠杆可以放大你的盈利,但也同时放大了你的亏损。因此,在使用杠杆的时候,一定要小心,确保你了解风险并制定相应的风险管理策略。

A4 : 下面的表格列出了常见的Online casino and How to find it ,至于「值不值得投资」的问题,这非常看于个人的投资目标、策略、以及风险承受能力。但以下三点是每个人都可以做的。

Research is key: It is very important to thoroughly research the technical foundation, development plan, team background, and market positioning before investing in any Online casino and How to find it. Risk management: Price volatility is great, so make sure your investment strategy and risk management measures are in place. Professional advice: Consider seeking professional financial advice before making investment decisions.

Is it worth investing in common Online casino and How to find it introductions? Bitcoin (Bitcoin, BTC) is the first and most well-known Online casino and How to find it. It uses blockchain technology and is often regarded as digital gold. Depending on individual circumstances.

It has a wide acceptance and high visibility, but it is also accompanied by high price volatility. Ethereum (Ethereum, ETH) provides a platform for smart contracts and decentralized applications (DApps) in addition to being a cryptocurrency. Depending on individual circumstances.

The application of Ethereum’s smart contracts is very extensive, but attention should also be paid to its price volatility and competitive situation. Litecoin (Litecoin, LTC) is often called ‘silver Bitcoin’, technically similar to Bitcoin but with some differences, such as faster transaction times. Many factors need to be considered.

Although it has some technical advantages, it also faces many competitors. Ripple (Ripple, XRP) mainly focuses on international payments and transfers.

XRP is the native currency on its blockchain network. Depending on the situation. Its application scenarios for international payments are extensive, but it is also affected by regulatory disputes. Cardano (Cardano, ADA) focuses on creating a more sustainable and scalable blockchain and focusing on the functionality of smart contracts. Research-oriented.

It has many attention-grabbing features, but it is still in the development stage, and investors need to closely monitor the progress. Plato (Polkadot, DOT) focuses on interoperability between blockchains.

It aims to allow different blockchain networks to communicate with each other easily. It should be studied in detail.

Its cross-chain function has great potential, but as an emerging technology, it still needs to face uncertainty and challenges.

A5: Maintain a skeptical attitude. If an investment promises high returns and no risk, it is likely to be a scam. Be cautious with all information provided privately about investment opportunities, and conduct thorough research before investing.

A6: NFT is a non-fungible token that represents ownership of digital assets. Its value comes from its uniqueness and scarcity. Considering their novelty and risk, investment should be cautious after full understanding.

A7: The process of ‘mining’ in Online casino and How to find it requires efficient hardware and a large amount of electricity.

This is a complex and highly competitive field. Unless you have a good understanding of it, newcomers may not want to participate first.

A8: The Online casino and How to find it market is very volatile. Before investing, set your profit and loss range, and when the market fluctuates, you can remain calm and adhere to your investment plan.

A9: Please treat any investment advice online with caution. Even from seemingly reliable sources, further verification and research is required.

A10: You can read books, attend courses, read related news about blockchain and Online casino and How to find it, and participate in investment and technology seminars or workshops.

A1 1: Not everyone is suitable for Online casino and How to find it investment, especially for those with low risk tolerance or unstable financial status. The following lists the characteristics of people who are more suitable for investing in cryptocurrencies for reference!

Why is it suitable for investment? Risk takers are not afraid to take certain risks The Online casino and How to find it market is highly volatile

Suitable for investors with a certain risk tolerance Tech enthusiasts are interested in blockchain and cryptocurrency technology and have a natural interest and enthusiasm for such investments

Long-term investors have a long-term investment perspective and strategy Online casino and How to find it investment requires a long-term perspective

To avoid short-term market fluctuations

And can hold and profit at the right time Diversified investors already have other types of investments

Wishing to further diversify their investment portfolios Online casino and How to find it can add diversity to the portfolio

Diversify risks and may bring additional returns Research-oriented investors are eager to learn new knowledge, keep a close eye on market dynamics, and continuously obtain and update market information

Young investors have longer investment time horizons and higher risk tolerance, and are more sensitive to emerging markets

And have a longer time

To balance and absorb fluctuations in investments

A1 2: When making money from investments in Online casino and How to find it, especially when you sell Online casino and How to find it for cash (i.e., ‘withdrawal’), you are likely to face tax issues. In most countries, the capital gains from Online casino and How to find it (such as profits from selling Online casino and How to find it) are usually subject to taxation.

Firstly, you sell Online casino and How to find it and convert it into legal currency (such as US dollars, euros, RMB, etc.). This selling process may generate capital gains that should be taxed.

You need to clearly record your purchase price (cost basis) and selling price, so that you can calculate your capital gains. If the purchase and selling prices are the same, you may not have any gains; if the selling price is lower than the purchase price, you may have capital losses, which may be used to offset your taxes in some cases.

To ensure compliance with tax laws, you may need to track and report all your Online casino and How to find it transactions to calculate your capital gains or losses. This may be a bit complex, especially if you have made a large number of transactions or used multiple platforms. The good news is that there are now many online tools and platforms that can help you track and report Online casino and How to find it transactions.

After obtaining the calculation results of capital appreciation, you usually need to fill in this information in the tax declaration of the country/region where you are located. Different countries/regions have different regulations on how to report Online casino and How to find it transactions, so please make sure to check the specific guidelines of your location.

In some countries/regions, if you use Online casino and How to find it for shopping or payment services, this may also be considered as a tax event that should be reported. That is to say, you may need to pay taxes on the goods or services purchased or paid for using Online casino and How to find it.

In general, the tax handling of Online casino and How to find it can be quite complex, especially when making a large number of transactions.

To invest in Online casino and How to find it, it is necessary to understand the market and analyze it, and choose a legal exchange to ensure safety.

Investors should control their investment behavior and not blindly chase the trend!

Consider both returns and risks: appropriately diversify the investment portfolio to reduce risk, and master the timing of investment to achieve maximum return.

That is how to invest in Online casino and How to find it? Detailed content of the 2025 beginner’s virtual currency investment guide, for more information about virtual currency investment guides, please pay attention to other relevant articles on script home!

Disclaimer: The content of this article does not represent the views and positions of this site, and does not constitute any investment advice of this platform. The content of this article is for reference only, and the risk is borne by the user!

Tag: Online casino and How to find it Newcomer