In-depth: Some people blew up their accounts at midnight, while others were ‘mining’ in the deep mountains. Unveiling the chaotic world behind virtual currencies

Hu Long Net reported at 5 pm on August 18th: (Chief Reporter She Zhenfang) Once, 1 US dollar could buy more than 1,000 bitcoins, but now it has soared to over 4,000 US dollars, an increase of over 4 million times in 8 years, and a surge of 50% in half a month. The wealth myth of Bitcoin has driven the popularity of virtual currencies, and has also attracted the attention of central media. Today, Xinhua News Agency published an article stating that ‘the risk of Bitcoin is intensifying, and the cage of the system needs to be tightened’. The reporter spent over a month interviewing several Bitcoin traders and miners, hearing many stories with both sadness and joy, and witnessing the various aspects of this market.

玩家:暴富、巨亏……365天*24小时 每分钟都在玩心跳游戏

8月16日中午12点10分,在观音桥一家咖啡馆,记者见到了匆匆赶来的陈烨。他看起来斯文干净,衣着朴素,但脸色苍白,黑眼圈颇为明显。

“没办法,自从开始炒币后,就天天睡不好。公司早上还要打卡。”他一落座就开始吐槽,“后悔啊!早知道这个月行情这么好,我不该在上个月平仓的。”

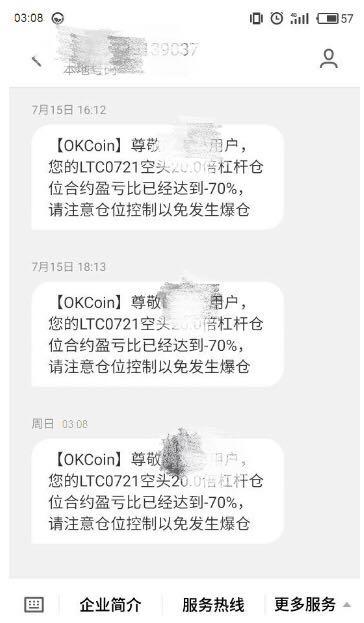

“尊敬的用户,您好,您的xxx杠杆仓位合约盈亏比已经达到-70%,请注意仓位控制以免发生爆仓。”记者看到,一个月前,他的手机塞满了同样的提示短信,有时一天多达几条。

陈烨告诉记者,之前他投入21000元,以10倍杠杆购买了10个比特币,建仓价格21000元,7月15日跌到19530元左右,亏损达到70%,接近爆仓。而如果一旦被系统强行平仓,所有的钱就没了。

平仓后,陈烨算了一下账,短短几天,21000元只剩下6300元。当时,他还庆幸没被女朋友知道,不然又要吵架,而眼看着平仓后行情一路高涨,他却又后悔不迭了。“这个月行情真是疯了,每天都在悔恨中煎熬,完全无心上班。”陈烨感叹道。

2017年5月12日,一场席卷全球互联网的勒索病毒,将比特币曝光在大众面前。很多人并不懂得比特币的原理,但这并不妨碍他们投入这种金钱游戏。

大量热钱涌入,今年6月11日,比特币创下3000美元的历史新高,合人民币约20322元,5天后暴跌19%,随后一路震荡。而8月以来,国内比特币价格又持续攀升。根据国内几家比特币交易平台的数据显示,8月初,一枚比特币的价格还在18000元人民币附近,半个月后就升至28000元附近,甚至一度超过29000元,涨幅超过50%。谁能想到,2009年比特币刚问世的时候,1美元就可以买1000个?

对于陈烨这种刚投身比特币市场的“小白”玩家来说,这些数字太过惊心动魄。但对于部分入市较早,长期持有比特币的玩家而言, 365天、24小时随时都可以交易,日涨跌幅无限制,这种全年无休的心跳游戏,早已令他们神经麻木。

“我是今年才接触比特币。重庆的玩家不多,江浙那边的人多,而且入市早,群里有个浙江餐饮老板,早年投入二十万,翻了一百倍,如今身家几千万。”陈烨说起群里的一些元老级人物,颇有点“生不逢时”的感觉。

Chen Ye added the reporter to several Bitcoin WeChat groups and QQ groups, in which everyone calls Litecoin ‘Spicy Stick’, Ethereum ‘Auntie Tai’, which has become a common code among them. Most of the time, everyone is discussing the market of various currencies, occasionally complaining about the strict boss and the difficult business.

According to statistics from domestic Bitcoin trading platforms, the current balance of customer funds on domestic trading platforms has reached dozens of billion yuan, with more than one million investors with asset sizes greater than zero.

For example, there is a legendary figure in the Baidu “Bitcoin” bar, known as the ‘480,000 brother’ by the netizens in the circle – this is because he opened a post on January 28, 2014, saying that he used 480,000 yuan in housing deposits saved by his family for seven or eight years to buy 100 Bitcoin. In the post, he said proudly, “Looking forward to making a big profit, buying a house with full payment, and if lucky, changing my car as well.” Most of the netizens in the circle did not look good at it, saying that the “tuition fee” was very high, and advised him to “invest less.” But he firmly believed in the bright prospects of Bitcoin.

However, as expected, the sky did not comply with people’s wishes. After the ‘480,000 brother’ bought the Bitcoin, it fell all the way, and he lost about 140,000 yuan in less than a month. Many netizens advised him to cut his losses, but he still insisted. In the middle, the market once warmed up, and the price rose back to 3,900 yuan, and many netizens were happy for him, but he still insisted that Bitcoin could reach 4,800 yuan and did not sell any. At the end of 2014 was the darkest day, and his account fell to only 190,000 yuan. “Hold on, don’t lose your mind,” kind-hearted netizens comforted him.

In early 2016, Bitcoin once again warmed up to about 3,000 yuan, and after two years of perseverance, he couldn’t hold on any longer, and he cut his losses. “The coins were sold, and the house was bought.” On January 7, he replied calmly in the post, after floating in the coin market for two years, from 480,000 to 300,000, this ID has never appeared since then.

Now, the comments on this post have reached over 130 pages, and it has become a landmark of the forum, with people visiting every day, feeling sorry for him – he has been steadfast for two years, experiencing several rounds of ups and downs, but still missed the big bull market in 2017. However, none of them are willing to believe that they would be as unlucky as him.

Anarchy: Counterfeit coins are dazzling, and the lowest price is 1 yuan for 2000 coins

“In the recent past, Bitcoin’s market performance was not good due to the expansion dispute, and many people turned to trade Litecoin, Ethereum, and other currencies.” Chen Ye told the reporter that currently, the main virtual currencies recognized by players mainly include these three types.online casino plan and What is it

In the virtual currency market, the market value of Bitcoin and Ethereum accounts for most of the territory. According to Coinmarketcap data, as of August 14, 2017, the global market value of encrypted digital assets is about 140 billion US dollars, with Bitcoin’s market value at about 71.8 billion US dollars, accounting for 51.28%. The market value of Ethereum hovers around 30 billion US dollars. Litecoin has also performed actively, with a surge of nearly 50% in 24 hours on June 17, reaching 48 US dollars, but on the whole, the total market value has been hovering around 2 billion US dollars in recent days.

随着虚拟币行情火爆,也诞生了数不胜数的“山寨币”。据报道,截至8月初,当前全球Online casino and How to find it 种类达 1025 种,过去 3 个月来增加了 200 种以上,相当于每天都会有一款以上的新Online casino and How to find it 诞生。

记者在某家号称“最专业的山寨币交易平台”看到,可以使用人民币交易的币种就多达四十多种,名字也令人眼花缭乱:狗狗币、猴宝币、无限币、谷壳币、黑币、世界币、企鹅链、传送币、最大币、美人鱼币、地球币等。

这些山寨币在涨跌上与比特币呈现出一定的跟随性和一致性,但幅度不一。每种货币有属于自己的上涨逻辑:国际上用户数仅次于比特币的狗狗币,其投资者寄希望于明年狗年利好;地球币投资者炒作的是自然、环保概念;幸运币原本依附于电子竞技平台,如今被赋予了爱心的美好寄托……

在价格方面,绝大部分山寨币都很低,记者看到许多币种价格都以分来计算,最低的一款“无限币”只有0.000597元,即1元可以购买接近2000个,这颇有点像比特币诞生之初,1美元可以购买1000个的情形。也不是所有的山寨币都受到追捧,成交额最低的一款是“LISK”,24小时成交额仅有142.23万元。(数据截至8月18日11时5分)

这些币为什么被称为“山寨币”?陈烨说,这是因为它们登陆的交易平台少,风险高,说不定哪天发行方就跑路了。这不是没有先例的,早在几年前,媒体就曾曝光过,一款号称实力认购的“咸丰币”,投资者认购后还未上线便跑路了,网站关闭,QQ群也被解散entrance lottery entrance and Latest。

“目前市面上99%的山寨币只具备投机价值,不具备投资价值,最终将会消失。”群里另一位资深玩家张江向记者断言。34岁的张江接触比特币已有7年,长期持有比特币,目前以水果直送生意为主。

挖矿:有公司老板欲花重金深山建“矿场”

1849年,数十万人涌入美国加州淘金。不少的淘金者淘到了或多或少的金子。但整个淘金热下来,赚到钱的却是那些卖耐穿的衣服和靴子、铁铲、淘洗金子金盘的人。在比特币淘金热中,也同样重复着“你们淘金我卖工具赚钱”的故事。

Initially, Bitcoin was set up to be obtained only through the massive computation of computers, commonly known as

In the second half of 2013,

Investigations show that the so-called

Some people have taken advantage of the loopholes. Reporters saw in a QQ group that some consumers purchased a large number of high-end graphics cards during the

But can mining really make people rich? Zhang Jiang frankly said that it is not as profitable as the rumors on the Internet. He invested more than 10,000 yuan in October 2013 to buy two of the most advanced Avalon Generation mining machines and mined them at home for several months. By the spring of the following year, due to the output being equal to the electricity bill, he stopped mining, and in the end, he only mined about 8 more coins. Subsequently, the cryptocurrency market fell into a long bear market, and he stopped mining.

Like other speculative markets, some people may make a fortune, but more people will get nothing. Some people eventually choose to give up.

’Listing’: Is ICO the modern version of the ‘Tulip Bubble’?

’Those who mine cryptocurrencies are now trading them, and those who trade them are now participating in ICOs.’ This sentence reflects the current situation of the virtual currency market to some extent.

Similar to the IPO (Initial Public Offering) in the stock market, ICO refers to the first public sale of Online casino and How to find it. Nowadays, due to the fact that once an ICO is successful and listed on a trading platform, it may bring several times or even dozens of times of wealth increase, various projects have received great attention, and their financing speed is so fast that it is unimaginable to the capital market. On March 16, the domestic smart contract innovation platform Quanlianchain began its ICO, raising 15 million US dollars worth of bitcoins and ethers in just 5 days; on April 26, the project Gnosis, dedicated to predicting the market, began its ICO, and the fundraising was completed in just 15 minutes.

In various groups, rumors are flying. ‘Hurry up, the某某 project will be launched in one hour.’ ‘Take me with you!’ Similar messages, once posted in the group, were surrounded by netizens. ICO projects initiated by well-known figures in the industry are more likely to gain people’s trust, such as the project initiated by Li Xiaolai, known as the ‘China’s Bitcoin Billionaire’, which made many players eagerly await. Some people also cursed, ‘Vampire, coming to suck blood again!’ They believe that too many ICOs have siphoned off funds, which is the main cause of the sharp decline in the market.

Journalists saw that on August 18, in a well-known public WeChat account in the cryptocurrency circle named ‘Daily Information’, there were 24 domestic ICO projects and 23 overseas projects listed.

Some people have dubbed virtual currencies as the modern version of the ‘Tulip Bubble’. In July, various coin prices fell, and ICOs (Initial Coin Offerings) failed one after another, which can’t help but remind people of the previous Xiaoyi stock – once the most popular stock in the market. Last September, Xiaoyi stock conducted its second ICO, raising more than 6,000 bitcoins at an average cost of 1.11 yuan per share, with a market value of about 25 million yuan, making it the largest ICO crowdfunding project in the country at the time. One month after the crowdfunding ended, most investors had not received their Xiaoyi shares with their private keys, and the stock was listed on the market. The opening price was diluted to 0.5 yuan, a significant drop from the cost price, and netizens questioned its ‘insider trading’ and ‘collusion’.

’Don’t blame netizens for questioning, many ICOs are just money-making, get rich quick, and then leave. For example, a well-known project was launched without even publishing a white paper. If you have spare money, you can get involved in private equity or at an early stage, but never buy at a high price and become a ‘shareholder.’

Online casino and What is it

Industry insiders say that the main problem with ICOs at present is the lack of unified information disclosure standards and procedures, which allows many problematic platforms to take advantage. At the same time, there is a serious speculative mindset among all parties. Some ICOs exaggerate their promotion in the early stage, which is seriously inconsistent with the facts, and there is no continuous supervision and constraint mechanism after financing. The head of a Chongqing-based company focusing on blockchain infrastructure technology also holds a cautious attitude towards ICOs. He told the reporter, ‘Economic development cannot do without hard work, and blockchain technology cannot be separated from the real economy. Many ICO projects on the market cannot bring wealth to society without real backing. Therefore, I am not optimistic about their prospects.’

Financial regulatory officials in Chongqing who do not want to disclose their names all told reporters that the People’s Bank of China has stated that virtual currencies are assets or commodities, not currency. Currently, the People’s Bank of China’s regulation of virtual currencies is mainly focused on anti-money laundering and other aspects. The Financial Affairs Office currently does not have a special regulatory department for virtual currencies – after all, new things develop too quickly, and regulation needs to be gradually improved.

Last month, the website of the People’s Bank of China’s Monetary Gold and Silver Bureau issued a risk alert on ‘the risk of issuing or promoting lottery and How to find it in the name of the People’s Bank of China’, stating that the People’s Bank of China has not issued any legal lottery and How to find it and has not authorized any institution or enterprise to issue legal lottery and How to find itentrance lottery entrance and Just click to enter. Currently, all so-called ‘lottery and How to find it’ on the market are not legal lottery and How to find it. The so-called ‘lottery and How to find it’ and the so-called promotion of the People’s Bank of China issuing lottery and How to find it may involve pyramid schemes and fraud. The public is urged to be aware of the risks, invest rationally and cautiously, and prevent their interests from being damaged.

This is a burgeoning market and an unpredictable field.

After typing the last line, a message popped up in the QQ group of nearly 2,000 members that the journalist joined: ‘Member ‘Happy Coin Trading’ has quit the group.’

In accordance with the interviewee’s request, all characters in the text are pseudonyms