(Finance Journalist Duan Jiuwei, Phoenix Finance)

’Raising 185 million US dollars in 5 days, market value surging to 5 billion US dollars ‘aircoins’’, ‘From 25,000 to 19,000 in half an hour’, the details of the short time and rollercoaster-like crazy wealth agitation in virtual currency trading in recent days have stimulated the nerves of the public.

Riches, losses, loneliness, faith, speculation, scams… These words with opposing meanings are all included and concentrated in the story of Bitcoin in China, as complex and contradictory as the money monster itself. In less than a year, during the so-called ‘bull market’ of Bitcoin in 2017, like a cyclic allegory, brave Chinese players twice performed their thrilling wealth game.

In 2009, when Bitcoin was just born, 1,300 Bitcoin could be exchanged for 1 US dollar, while by this September, the highest price of Bitcoin surged to 4,900 US dollars, an increase of 63.7 million times in 8 years. From 2013, when young Chinese tech enthusiasts developed the world’s first ‘mining machine’ and ‘mining farm’, to 2017, it is estimated that over 70% of Bitcoin production was in China. The story of Bitcoin in China, driven by idealistic new Online casino and How to find it technology, was rapidly pushed into an explosive wealth creation legend by players and capital.

Since the recent sharp decline, some traders have ‘predicted that Bitcoin will break through the 100,000 yuan mark this year’, while others bought more than 66,000 units of a certain altcoin at a high price of over 3 yuan, now it has dropped to 0.3 yuan and they are still holding on, ‘waiting to break even’. After the trading channels were cut off, where will these massive funds, with a strong wealth impulse and totaling over 100 billion yuan, go?

2000年互联网泡沫破灭后,美国作家刘易斯写了《为繁荣辩护》一文:“一场没有欺骗的繁荣,就像一条没有跳蚤的狗一样。”而在这场浓缩了当下中国的财富焦虑、躁动,演变至投机资本癫狂的博弈游戏里,有哪些需要辨别是非、哪些需要辩护?

相同的寓言

“怎么涨上来的,怎么跌回去。”

没有被很多人注意到的是,2017年5月12日是2017年比特币“大牛市”的重要日子。

当天,爆发于高校电脑的“比特币勒索病毒”席卷全球,被感染者电脑系统文件全部被加密,需要支付5个比特币(等值300美元)的赎金才能被解锁。比特币进入了大众视野,成交量首次放量突破,很多人也许并不懂比特币的原理,但并不妨碍他们加入这个金钱游戏。

在2017年5月,年轻的职业操盘手大树拿出了股市所获利润50万元,加入了虚拟币玩家队伍,数月后,账户收益增至100多万,并又在短短几天“币灾”中回吐了30万元利润。

2017年5月12日的前一天,上证指数刚刚经历了年内最低3016点。

5月12日之后几天,比特币经过缩量阴跌调整,随即迎来了2017年的首波显著放量拉升,币价也随之冲破了8000元大关。而在这之前,比特币单价已经在低位横盘了将近4年。

2013年11月,比特币价经历了历史性阶段最高、超过8000元(1242美元)关口,但由于大量热钱涌入引发监管关注,进入12月后暴跌,单日跌幅最多达到7成,随后开启了“漫漫熊途”,期间最低价位一度跌至千元以下。

也在这一年,从事财经媒体行业的老谭以400元左右、900元左右的价位入手了比特币,并数次加仓,一直持有至今。以9月22日最新币价2.2万元计算,老谭的收益增幅高达3385%。

“一般的心脏根本受不了。”虚拟币玩家夏江说,币价波动太频繁了。之前连A股都不碰的他,对虚拟币一天超过10%涨跌幅已经习以为常。今年5月份,夏江抱着试一试的心态,买了一枚比特币,但短短几天,收益翻番,仅一笔净赚了近10000元。online and The latest method

进入6月份,在比特币价格高企后,夏江拿出自己三年工作的积蓄共计4.2万元,在以太坊eth(火币)的历史高位2600元左右,全部买入了以太坊eth(火币),但这次,紧接着迎来的,却是连续暴跌。

随着大量热钱涌入,部分投资者兑现利润出局,筹码松动,“币灾”来了。2017年6月11日,比特币创下20322元(合约3000美元)的历史新高,随后5天后暴跌19%,此后又遭遇比特币“硬分叉”风险拖累,在6月27日、7月15日,比特币缩量暴跌,其它虚拟币种都被波及。

“整个人蒙了,那么快跌下来,谁想到要去卖出去。”夏江从最高2600元买入,到跌至1500元左右,全部清仓,收益近乎腰斩。此后,以太坊eth(火币)小幅反弹但再次暴跌,最低跌至941.26元。

从虚拟币交易平台火币网的数据来看,今天5月,像大树、夏江这样入场玩家不在少数。随着大量热钱涌入,5月25日,火币网数据显示,比特币价格创阶段性新高,从约1.5万元逼近2万元,但是5月26日,比特币又跌落至最低约1.4万元,同时,当天创下了32360的交易数量,为比特币8年多交易历史以来的第二高量值。

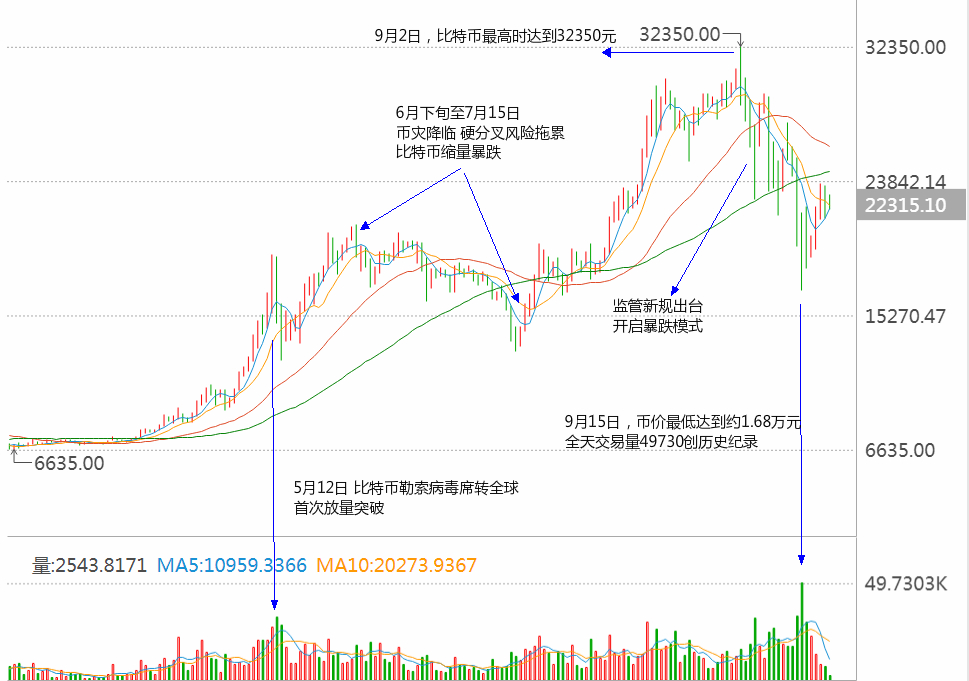

接下来在7月底到9月,就是大众更为熟知的剧情走向:7月16日比特币1万多,9月2日,价格最高时达到32350元,紧接着,受七部门出台监管新规、数个比特币交易所关闭、监管层将严控虚拟币境外交易渠道等消息影响,比特币价连续暴跌。

9月14日晚间半小时内,比特币价出现从最高2.5万多元跌至1.9万多元,9月15日,币价最低达到约1.68万元,相比9月2日的历史高价,10余天内价格再度腰斩。截至9月21日下午,比特币报价约2.23万元。而根据“比特时代”最新数据统计,招财币、狗狗币,等部分山寨币值已跌至最高价时的10%以下。

仿佛经历了又一轮的相同的寓言,只是在这次这场两个多月的“过山车式”的游戏里,无论向上还是向下,速度都更快,也更激进。

“怎么涨上去,就怎么跌下来。”大树说,“真的太疯狂了。”

今年7月,在行情“疯狂”的比特币交易里进进出出了数次后,大树选择了更疯狂的ICO交易。

疯狂的进阶

“买哪个,哪个就涨”

一个深圳的“小白”炒家,拿一千多万元玩ICO项目,最多时赚到2500万元,一天之内,亏到只剩700多万元。“要么暴赚,要么血本无归”。这是进入9月,央行等七部委监管新规出台前后,ICO项目微信群里常见的故事之一。

In the world of virtual currency players, transactions like Bitcoin are called speculating in the ‘secondary market,’ similar to stock trading in the securities market; ICO transactions, short for Initial Coin Offering, are the first public sale online, similar to the IPO in the securities market and are regarded as the ‘primary market.’ According to Sun Zeyu, co-founder of Kuangshen and a senior investor in Bitcoin, an ICO can be divided into three parts: crowdfunding, token distribution, and the token listing on the exchange.

In simple terms, the play is that when an application scenario project based on blockchain technology launches an ICO, it divides the shares or revenue rights of the project into several parts and publicly sells them for subscription; while the subscribers participate in the rush to buy, similar to the ‘new share subscription’ in the stock market, but it is first to use funds to purchase various virtual currencies, and then to participate in the subscription. Once the ICO is successful and listed on the trading platform, as long as it does not break below the issue price, the price of the virtual currency held by the subscribers will skyrocket, at which point it can be bought and sold to earn a profit and increase wealth.

In the ICO market, projects with big V endorsements, application scenarios, market value management, and small market size are often considered ‘quality projects’ and are often snapped up, with fundraising speeds that are hard for the capital market to imagine. ‘Buy whatever, it will rise. Some projects endorsed by big V’s are so popular that they are sold out in seconds,’ during the ICO transactions between July and early August, Da Shu ‘almost never missed a shot, and always made a profit.’

”Double the price in a month, even an idiot would want to join in.” Da Shu has operated multiple ICO projects such as OMG, Super Cash, ACT, and PST, with the trading principle being ‘run after listing and do not hold positions.’ This July, with an initial capital of over 80,000 yuan, Da Shu purchased over 40 cryptocurrencies to participate in the PST project. One month later, he sold out all his holdings, netting a profit of 100,000 yuan. ‘If it were not for the regulatory measures, this would be a paradise for speculation.’

The project ‘Qtum Quantum Chain’ initiated by Patrick Shaochu, after its ‘listing,’ reached a peak price of 66.66 yuan, with a gain of 33 times;

The ‘OMG’ project issued by the OmiseGo wallet, with an ICO cost of 2 yuan, reached a peak price of over 80 yuan, with a gain of more than 40 times;

For other ICO projects, statistics show that during the public crowdsale of公信宝, ‘1 share’ was several cents, which increased by more than 90 times; the price of AntCoin from the initial crowdsale, when the cost of one share was less than 50 cents, rose to 100 yuan; Stratis increased by 1500 times in one year; more widely spread is that Li Xiaolai, who initiated multiple ICO projects, founded the EOS blockchain project without any tangible products, raised 185 million US dollars in financing in just 5 days, reached 5 billion US dollars in the secondary market, and was called the ‘5 billion US dollar air’…

The profit-seeking nature of economic individuals is a fundamental proposition of the capital society, and an unchanging rule in the history of finance is that the effect of infinite expansion of wealth brings about illusions and mania.

News about the founder of the ICO project manipulating the market, some projects running away with the money, suspected of illegal fund-raising, money laundering, and other issues have been spreading one after another.

At 3 pm on September 4, the central bank and seven other ministries clearly defined ICO as illegal public financing and suspected of financial fraud and pyramid selling, and stricter supervision was on the horizon. Trading was suspended, and multiple ICO projects directly returned the coins.

The opportunity for the birth of ICO was to allow a group of blockchain industry entrepreneurs to find a new way of financing. As early as July 2014, the Ethereum project successfully completed an ICO, raising a record 30,000 plus bitcoins, which attracted extensive attention and ushered in an outbreak in 2017.lottery help and The latest website

“It is a very good fundraising model, but it has been turned into a game of hot potato by domestic speculators.” Qiu Shaosao, an IT expert living in Tokyo, Japan, and a veteran Bitcoin player, does not agree with simply separating Bitcoin from blockchain, encourages the development of blockchain while curbing Bitcoin, but also feels sorry that Bitcoin and ICO have become a chaotic game filled with speculation and money-raising phenomena?

The evolution of big V

Born with idealism, and grew疯狂 due to greed.

Recently, Li Xiaolai still hardly accepts public media interviews, but maintains the activity on his personal verified microblog, updating one or two short sentences every day, with responses, justifications, complaints to the outside world, as well as reflections on investment, in which the rebellious personal temperament can still be felt; from a TOEFL teacher at New Oriental, author of the best-selling book ‘Make Time Your Friend’, to later joining the knowledge-sharing platform under the Logic Thinking brand, opening the column ‘The Path to Wealth Freedom’, becoming a popular financial management opinion leader, and then in 2017 being rumored as ‘China’s first Bitcoin billionaire’, becoming a ‘big V’ in the Bitcoin circle, especially in the ICO circle, his road to fame is as dazzling as his ICO project.

In 2011, when the story of Bitcoin in China originated, it was another group of people with different temperaments. The Chinese author of ‘GQ’, senior media person Zeng Ming, once searched for the beginning of the story of Bitcoin in China, a group of young people who yearned for a technical paradise and monetary democracy, full of idealism and passion, determined to popularize this emerging decentralized, anti-inflation Online casino and How to find it in China.

Among this group, there are college students, technical geeks, winners of the ‘Galaxy Award’ in the science fiction circle,有声书公司老板 who were imprisoned for involving pornography, and Qidian writers. Among them, for example, Zhang Nangeng (also known as ‘Pumpkin Zhang’) and Liu Zhipeng (also known as ‘Changxia’), later became the founders of China’s first miner and the first Bitcoin information website.

In the story of that time, the Chinese Bitcoin wealth myth originated from ‘mining’. In early 2013, Zhang Nangeng developed the first Avalon miner and sold it worldwide. Subsequently, Jiang Xinyu, a young college student from the Class of 2001 at the University of Science and Technology of China (also known as ‘Kao Mao’), also developed the Avalon miner and established the world’s first mining farm composed of this miner, mining 40,000 bitcoins a month, valued at tens of millions of yuan. The price of Bitcoin rose, and in November of that year, the price per unit was the first to exceed the price of an ounce of gold.

Mining has become a business that is sure to make a profit, with the stimulus of wealth more motivating than science popularization. The Chinese are never short of a keen sense of wealth stories and the ability to replicate them. Soon, many capitals rushed in, manufacturing tens of thousands of Avalon mining machines on the production line. In two years, the total computing power of the Bitcoin network, representing mining skills, increased 12,000 times. According to the latest statistics, 75% of the world’s Bitcoin is produced in China.

Zeng Ming’s observation in 2013 was, ‘Bitcoin was born with idealism, grew wildly with greed, and ended in confusion. In the end, Chinese players have gradually made Bitcoin the antithesis of its own value.’

Even now, the coal and electricity energy city of Ordos in China and the hydropower-rich region of Sichuan-Tibet borderland are still famous Bitcoin ‘mining fields’.

But recently, with the cold reception of domestic trading platforms, there have been many second-hand ‘mining machines’ and accessories being sold at a discount on second-hand trading websites such as Xianyu and ZhuanZhuan. A seller in Fengfeng mining area of Handan just reduced the price of a 90% new mining machine from 8,000 yuan to 6,500 yuan three days ago.

A defense of prosperity

A dream of sudden wealth

Who wants to transfer Bitcoin! How much, I’ll take how much

Messages kept popping up in the WeChat group of the virtual currency circle on the phone, ‘Who wants to transfer Bitcoin! How much, I’ll take how much.’

At that time, the supervision had been tightened, and the storm was about to break. The latest news is that underground transactions and overseas routes of some coin holders will be strictly regulated.

According to the real-time trading data of Huobi’s Bitcoin, as of 22:30 on September 21, 2017, the trading volume was only 2397, which was only 4.82% of the trading volume on the first day after the new regulations on the closure of trading platforms were introduced, that is, September 15, when the total trading volume was 49,730. After nearly a ‘stampede’ of buying and selling in the past two days, with the closure of the platform approaching, the trading volume of virtual currencies has shrunk significantly.

In early August this year, after Xia Jiang cleared his position in Ethereum, he did not leave the virtual currency market but instead studied blockchain technology and theory systematically and heavily invested in Litecoin. After the new regulatory measures were introduced in September and the value of the currency plummeted, Xia Jiang just added 15,000 yuan to his position again, despite the floating loss in his account still being substantial, ‘If Bitcoin continues to hold strong, I feel that it may really break through 100,000 yuan by the end of the year.’

At the same time, Lao Tan, who bought and held firmly at a price below 1000 yuan as early as 2013, also seemed calm, saying, ‘The only thing to do is to keep accumulating.’ Da Shu, who has made considerable gains in short-term trading in the past three months, has chosen to watch and wait.

There is a legendary post on the Baidu ‘Bitcoin Bar’ forum, where the poster ‘Encounter in Notting Hill’ bought 100 Bitcoins with all the savings of 7 or 8 years and the house purchase fund of 480,000 yuan in 2014, ‘ready to make a big profit’. But after incurring a loss of nearly 200,000 yuan, he sold out. However, the post is still receiving comments every day, with people asking ‘What happened later? Did the poster sell it?’ One of the latest comments from a netizen is that he heavily invested in more than 66,000 Shangya coins, a type of altcoin, at a historical high of over 3 yuan, but the latest price of the coin is less than 0.3 yuan, once as low as 0.16 yuan, ‘hoping for the day when there is a way out.’

online and The latest plan

Traders like Xia Jiang, Da Shu, Lao Tan, and Qiu Shaoguo are all distributed in the chain of a virtual currency circle resembling a ‘pyramid’. In the view of analysts, the top of the pyramid is made up of elite figures from the IT industry and the field of science and finance, who are the designers and pioneers of the game rules; downward, represented by capital tycoons, private equity, venture capital, merchants, and other capital forces, participate in the pursuit of huge profits; the third category includes some cheerleaders who stand up and promote ICOs and virtual currencies, aiming to get rich; at the bottom, there are various small and medium-sized investors.

But the storm has already arrived, who can escape it?

When asked to describe virtual currency trading in one word, Da Shu thought for no time, ‘A dream of rapid wealth.’

In an interview with Caixin journalist, Li Xiaolai commented on the blockchain project Press One he endorsed, saying, ‘It was a good thing, but we encountered an irresistible force. I don’t blame anyone. I sincerely believe that the regulation was out of good intentions, but we just met at the wrong time.’

Li Lin, the founder and chairman of Huobi, refused an interview with Phoenix Finance, with the only reply being, ‘Focus is mainly on the withdrawal of business, protecting user assets,’ and no other statements or comments were made.

‘Prefer high-risk, high-yield does not mean disorder or irrationality,’ Qiu Shaoguo observed. Although the volume of Bitcoin trading in China has decreased, the global trading volume remains active. Under orderly trading regulations and awareness, the holding and trading of virtual currencies are still a form of asset management and will exist in the long term.

According to the data released by Autonomous NEXT, a financial technology analysis company, in July 2017, the ICO financing worldwide in 2014, 2015, and 2016 was $26 million, $14 million, and $2.22 billion respectively. In 2017, this figure soared to $1.266 billion, nearly 5 times the total financing amount of the past three years. In mainland China, according to the latest report released by the National Internet Financial Security Technology Expert Committee, as of July this year, the financing of ICO projects in the first half of the year was approximately 26 billion yuan in RMB, which means that China’s share of the global scale in ICO project transactions exceeded 30%.

After the official channels at home were cut off, where would such a large sum of 100 billion yuan, driven by a strong urge for wealth, go?

(Note: The names Da Shu, Xia Jiang, Qiu Shaoguo are pseudonyms used per the interviewee’s request. This article is an original piece by Phoenix Finance and is strictly prohibited from being republished without permission. Copyright infringement will be pursued to the fullest extent of the law.)