When it comes to cryptocurrencies or Online casino and How to find it, many people will first think of Bitcoin (BTC). As the largest cryptocurrency by market value at present, Bitcoin is the investment choice for many newcomers to the cryptocurrency industry. Miners worldwide are also trying their best to obtain it, which has also caused a shortage of graphics cards globally.

So, what is Bitcoin? Why does Bitcoin need to be mined? And how to mine Bitcoin?

This article will guide you to understand in detail what Bitcoin mining is, the principles of Bitcoin mining, websites, as well as tutorials and risks of mining Bitcoin. Those who want to become Bitcoin miners should not miss it!

On April 20th, 8:09 a.m. Taiwan time, Bitcoin completed its fourth halving, and the miner’s mining reward was reduced from 6.25 BTC to 3.125 BTC. Although the miner’s block reward was greatly reduced, due to the highly anticipated Bitcoin token protocol Runes going online at the same time as the halving, Bitcoin transaction fees hit a historical high, and Bitcoin miners’ income also reached a record high of 107 million US dollars on the 21st.

In a sense, Bitcoin (Bitcoin) can be said to be synonymous with Online casino and How to find it. It is not only the earliest launched cryptocurrency but also the one with the highest market value at present.

Bitcoin is a decentralized Online casino and How to find it that does not require banks or government institutions. As a ‘online currency’ different from physical currency forms, Bitcoin carries out fund transfers through the Internet.

身为目前最火红数位货币之一的比特币,由于获取难度高,且物以稀为贵的条件下,导致比特币的相对价值非常高。在数位货币市场上,比特币被当成一种「股 票」操作,它可以用来当作保值品投资,也可以将其转换成各国货币并存入现行银行帐户,许多网路商店(全家、711)甚至支援直接使用比特币购买商品。

当前想要获得比特币的方法有两种,一种是用金钱购买,而另一种则是透过挖矿获得比特币online casino entry method and How to find it。

用金钱购买是获得比特币最快的方法,在撰写本文时(2024/4/23),一个比特币的价格66,770 美元,约为217 万新台币。

如果你想要购买比特币,你需要先获得一个Online casino and How to find it 钱包。通常,你可以通过注册一个交易所帐户来获得,这也方便你进行后续的交易操作。

不过,由于比特币单价价格昂贵,因此也会有不少人选择成为一名比特币「矿工」来获得BTC。这种方式称为「比特币挖矿」。

比特币的发行有它自己的时间以及数量,大约每十分钟会由程式码执行新比特币的发行,并且授予给参与比特币交易的某(群)人,因此,获得新发行的比特币就好比是获得刚出土的金矿,所以才会将这些获得比特币的人比喻为矿工。

由于其特定的共识机制——工作量证明(PoW)以及大型矿工的参与,比特币目前是最安全的区块链之一。除了挖矿提供的安全性之外,该过程还充当加密货币的唯一发行系统,即将新铸造的硬币作为激励释放给矿工。

比特币挖矿是比特币网路安全的重要组成部分,也是发行新币的唯一机制。参与此操作的人被称为矿工,他们通过调动强大的计算设备竞争成为比特币区块链上新区块的成功验证者,从而将网路交易费用和新铸造的硬币收入囊中。

在下文,我们将详细讨论什么是加密货币挖矿,如何开采比特币,比特币挖矿是如何运作的,开采比特币的成本,比特币开采是否非法,以及矿工面临的各种比特币开采问题。

在挖掘比特币的过程中,矿工充当比特币网路的审计员,负责验证新交易的有效性,并在验证后将它们添加到区块链中。这项任务有助于消除所谓的双重支出的可能性。与法定货币系统不同,加密货币网路的去中心化结构使它们面临这种独特类型的问题。为了使网路可行,必须能够验证参与者没有试图通过两次花费相同的硬币来超越系统,并且这必须在没有银行或任何其他中介干预的情况下完成。

To prevent the possibility of double spending, the task of miners is to verify transactions. In each case, miners will confirm the validity of the new 1 MB bitcoin transactions, and then they will be added to the bitcoin blockchain as long as they successfully meet other requirements proposed by the network consensus mechanism.

The setting of 1 MB is determined by the infrastructure design of the bitcoin protocol. The creators of bitcoin designed each block to have a fixed size of 1 MB. Therefore, it is impossible to load transaction data exceeding this limit.

After verifying transactions worth 1 MB, miners become eligible to mine new coins. This does not mean that miners will automatically receive bitcoins as a reward for verifying these transactions; on the contrary, miners must compete with other miners to become the first miner to successfully verify and therefore guarantee the next new transaction block on the bitcoin blockchain.online casino secrets and The latest method

It is worth noting that the difficulty of mining bitcoins is not constant.

Since the bitcoin network is completely decentralized and not operated by any single overall authority, the algorithm hardcoded by the creator of bitcoin, Satoshi Nakamoto, into the original code is used. This algorithm continuously adjusts the difficulty of the bitcoin mining process based on the number of miners in the network to ensure the discovery of blocks at a stable rate.

The bitcoin mining difficulty algorithm is designed to find new blocks by maintaining a duration of 10 minutes, in order to maintain the stability of the entire system. Essentially, it takes about 10 minutes for a miner in the entire network to generate a winning code and win the right to propose a new bitcoin transaction block to be added to the blockchain.

To maintain this frequency, the algorithm intervenes and adjusts the difficulty of mining bitcoins by increasing or decreasing it. Whenever there is an influx of miners or mining equipment, it increases the difficulty of bitcoin mining; if the situation is reversed, the agreement will reduce the mining difficulty. The mining difficulty of the bitcoin network is changed by adding or removing zeros before the target hash value.

The target hash is the name of the specific hash (fixed-length code) that all miners strive to defeat. The person who generates a random code with an exact or greater number of zeros than the target hash will be selected as the winner.

Without such a system, as more and more miners join the network with increasingly complex equipment, blocks may be discovered more quickly. This will lead to new bitcoins entering circulation at an unpredictable rate, and may trigger a chain reaction that suppresses their value appreciation.

The halving of Bitcoin refers to the event where the reward for mining new Bitcoin blocks is halved, which means the amount of Bitcoin received by miners for verifying transactions is reduced by 50%. The halving of Bitcoin occurs approximately every four years, with the last halving occurring on April 20, 2024, reducing the block reward from 6.25 BTC to 3.125 BTC.

As the halving of Bitcoin approaches, the amount of Bitcoin (BTC) held by cryptocurrency miners has dropped to the lowest level since July 2021. Data tracked by Glassnode shows that the estimated amount of BTC held in wallets related to miners has decreased by 8,426 BTC (5.3 billion US dollars) since the beginning of this year, currently at 1,812,482 BTC.

The Toronto-based cryptocurrency platform FRNT Financial said that to improve profitability, miners may use stored BTC to purchase more efficient equipment, thereby reducing operating costs. In addition, ‘miners may also be inclined to sell in order to occupy a better position before the halving.’

Bitcoin miners indeed own and operate powerful and complex computing equipment to try to solve highly complex mathematical problems, which is the core requirement to become a successful Bitcoin miner. The profitability of miners largely depends on the quality of their hardware and how quickly they can solve these problems before other competing miners.

For safety reasons, the network’s proof of work system uses the so-called secure hash algorithm 256 (SHA-256) in cryptography. SHA-256 outputs a 256-bit hash value and encrypts the input.

These hash functions are pseudo-random, so it is almost impossible to predict any input output before running the input through the hash function. In order to add a new block to the blockchain and claim the reward for newly mined Bitcoin, miners need to use their computing resources for intensive and extremely fast mathematical guesses to produce a valid hash value threshold below a certain specific value, known as the target.

Therefore, mining requires powerful and competitive computing resources, which is why hardware requirements are such an important part of mining.

After understanding the principle of Bitcoin mining and the requirements of miners, the next step is to learn how to mine Bitcoin.

If you want to start mining, there are some preliminary preparations to be made before you start, including hardware investment costs and operating costs. The former refers to the costs of purchasing, installing, electricity, depreciation, site, and cooling, etc.; while the latter is the cost required to maintain the continuous operation of these hardware. After combining both, it can be found that the cost required for mining is actually very large, which is why some with a large amount of capital establish mining-specific hardware equipment and recover costs through the ‘rental’ method. This mining model is packaged as a ‘commodity’ and traded on the open network market. When mining Bitcoin, the mining is distributed according to the payment ratio of each tenant, and this mining model is what is called ‘cloud mining’.

There are mainly three methods for mining Bitcoin, in addition to cloud mining, there is also ‘independent mining’ and ‘cooperative mining’. However, due to the continuous increase in mining difficulty and the increasing number of competitors, it is unlikely to mine Bitcoin independently with one’s own strength today. Although once mining is successful, one can obtain all the benefits alone, but the more feasible method is to adopt the latter ‘cooperative mining’, which is the concept of team mining. When mining, the entire team divides the mine according to each person’s contribution ratio.

When understanding Bitcoin mining, we cannot avoid mining pools and mining machines. So, what are they?

When Bitcoin was not very popular, most people used their own computers to mine, of course, using the full CPU power at first. Then, some people found that using the GPU Stream Processors of the graphics card for calculation would be faster. However, when everyone invested in mining, many optimized devices for mining emerged, which were simply uncompetitive for general personal computers. Therefore, it was necessary to join a mining pool (Mining Pool) to mine, where the server collects all the computational power of users to mine, and then a certain proportion is returned to the users (miners), so that it would not happen that after mining for a long time, one still could not compete with professional mining machines, spending electricity bills but getting nothing.

Although graphics cards are faster in mining speed, the display chips were originally not specifically designed for mining, so mining with graphics cards not only consumes a lot of electricity but also generates a lot of heat. If it is a mining computer composed of 3 or 4 graphics cards, it is even more power-consuming. In the end, the potential profit from mining Bitcoin may not even be enough to cover the electricity bill! Therefore, since 2013, the focus of Bitcoin mining has gradually shifted to professional mining machines, which are divided into two major types:

FPGA (Field Programmable Gate Array, Field Programmable Gate Array): It is a parallel architecture logic chip that can be reprogrammed and designed repeatedly, with the software burned onto the FPGA for operation, and the internal logic blocks can be connected together by programming, with the advantages of easy modification and lower cost. However, the disadvantages are that the speed is relatively slow and it cannot complete complex designs, and the power consumption is also relatively high. ASIC (Application-specific integrated circuit): Different from the flexible and elastic characteristics of FPGA, ASIC is designed for specific applications, such as chips specifically designed for mining, which is optimized for Hash calculationonline website sports and The latest website. Of course, compared to FPGA, ASIC has higher performance, and compared to graphics cards, ASIC has a dedicated function, without the need to add a lot of unnecessary chips or capacitors. Of course, the power consumption is much lower, and long-term use not only saves electricity bills but also improves computational power by tens or even hundreds of times. Professional mining machines are mostly ASIC architecture.

The choice of mining machines requires consideration of not only the mining algorithm of the cryptocurrency, but also the advantages and disadvantages of ASIC mining machines and GPU (graphics card) mining machines for users.

ASIC 矿机的优点在于:(1)单机的算力相对较大;(2)管理矿机方便,适合大量部署;(3)操作简单,移动方便,机器比较稳定。

ASIC 矿机缺点也不少:(1)只能挖固定算法的币种;(2)噪声比较大;(3)保值特性差。

GPU(显示卡)矿机的优点是:(1)可以根据收益,灵活切换挖矿币种;(2)噪声小,功耗低;(3)显卡用途广泛,比较保值。

GPU(显示卡)矿机也有其缺点:(1)显卡矿机体积较大,组装麻烦,不宜搬动,大规模布置比较麻烦;(2)矿机批量管理工具较少,集群化管理较为麻烦;(3)GPU(显示卡)矿机超频、刷BIOS、硬件维修等操作有一定难度,需要深入了解。

总而言之,投资者在选择矿机前,除了需要考虑到币种的挖矿算法对矿机的限制外,还要对ASIC矿机和GPU(显矿卡)矿机的优缺点作一番参考,以辨别属于自己的最佳投资选择。

挖矿的过程并不复杂,只需要下载「挖矿程式」其实就能开始挖矿。网路上的比特币挖矿软体百百款,这里我们将以NiceHash Miner 这款软体举例说明。

首先,根据手上显卡厂商下载对应的NiceHash Miner 版本并开启软体,在正式开始挖矿以前,有几个步骤要先设定。

电子钱包页面中最重要的资讯就是钱包地址,这除了是比特币买卖家交易时须使用的资讯以外,同时也是挖矿时比特币储存的目标位址,点击币托页面中的钱包地址后,就会获得一串「未命名的钱包地址」,请复制这串数位码并好好保存。lottery online website and The latest method

接下来在挖矿程式中点击「钱包」(Wallet)选项,将刚刚复制的数位码贴上后即可完成储存目标设定。在左下方的「硬体资讯」(Hardware Details)选项中,系统预设会找到你电脑使用的显示卡型号,也可以在这里开启处理器加入挖矿的行列,可根据需求和喜好设定。

一切都准备就绪后,就可以按下中间的「开始挖矿」(Start),你的电脑会自动开启命令执行视窗进行挖矿,不同的挖矿软体无论每次挖矿的动作成功与否,都会释出不同的通知指令,以NiceHash 为例,成功挖矿时视窗上将会出现的绿色的指令通知。但这时候软体挖到的比特币数额其实非常小,需要长时间连续不间断的挖矿才能挖到完整一个比特币。

比特币网路透过为生成新区块提供奖励的形式认可比特币矿工的工作。有两种类型的奖励,分别为:每个区块创建的新比特币,以及用户在网路上进行交易所支付的费用。

那么,比特币矿工能赚多少钱呢?

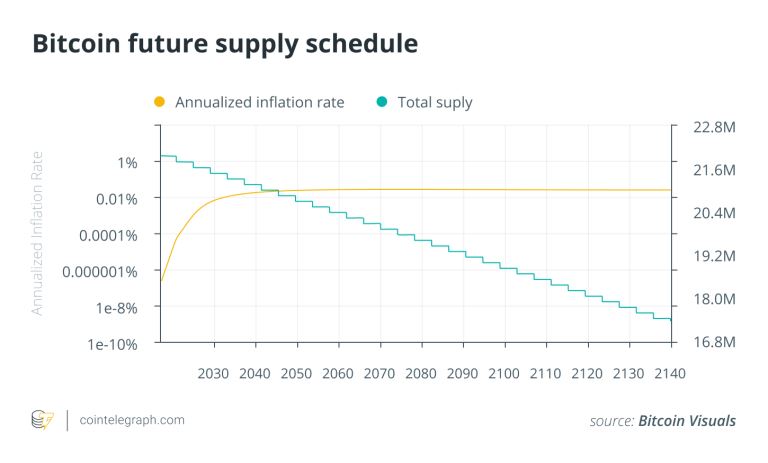

截至2023 年11 月,新铸造的比特币的区块奖励为6.25 BTC,占矿工收入的大部分。该值被编程为以大约四年的固定间隔减半,以便最终不再开采比特币,只有交易费用才能保证网路的安全。

到2040 年,区块奖励将降至不到0.2 BTC,2,100 万枚比特币中只剩下8 万枚可供争夺。只有在2140 年之后,随着最终的BTC 被缓慢开采,挖矿实际上才会结束。

尽管区块奖励随着时间的推移而减少,但过去的减半已经透过比特币价格的上涨得到了充分补偿。虽然这并不能保证未来的结果,但比特币矿工对其前景享有相对程度的确定性。

社区非常支持当前的挖矿安排,并且没有计划像另一个主要可开采硬币以太坊那样逐步淘汰它。

除了硬体的选择之外,单一矿工的利润和收入在很大程度上取决于市场状况和其他矿工的存在。在牛市期间,比特币的价格可能会飙升,这导致他们开采的比特币以美元计算的价值更高。

然而,牛市带来的积极资金流入被其他比特币矿商看到利润增加并购买更多设备以利用收入流所抵消。结果是每个矿工现在产生的比特币比以前少了。

最终,产生的收入趋向于一个平衡点,效率较低的矿工开始赚到的钱少于他们花在电力上的钱,从而关闭设备并允许其他人赚取更多的比特币。

通常,这不会立即发生。存在一定的滞后性,因为ASIC 的生产速度有时无法足够快地弥补比特币价格的上涨。

在熊市中,相反的原则成立:收入下降,直到矿工开始集体关闭他们的设备。为了避免在竞争中被击败,现有的比特币矿工必须找到一个有利的位置和硬体组合,使他们能够保持优势。他们还必须不断维持和再投资其资本,因为更有效率的硬体可能会完全扼杀老矿工的利润。

在过去几年里,以比特币为首加密货币浪潮席卷市场,引发了不少公司加入挖矿中,其中不少新兴公司仅以开采比特币为基础进行营运。

其中,持有比特币(BTC)最多的顶级比特币矿业公司是Marathon Digital Holdings,拥有13,726 BTC。 Marathon Digital 占所有知名比特币矿业公司BTC 持有量的35%。它运作超过15 万台采矿设备,安装的算力为每秒23.1 Exahash (EH/s),占全球比特币网路的4.8%。

Marathon Digital 也是市值最高的比特币挖矿公司之一,其市值为16.4 亿美元,与Riot Platforms 持平。这几乎是市值第二大矿业公司的两倍。这家顶级比特币挖矿公司过去12 个月(TTM) 的收入为1,700 万美元,较上一时期成长47.8%。

不过,目前前14 名的比特币挖矿公司总共持有38,903 枚比特币。然而,这仅占2,100 万比特币最大供应量的0.18%,远低于MicroStrategy 的152,333 比特币持有量。其中,前三名的比特币挖矿公司(Marathon Digital、Hut 8 Mining Corp 和Riot Platforms )均持有超过3000 枚比特币。相比之下,其余11 家公司每家持有BTC 不足3,000 个,总计8,502 个BTC。

无论你是使用金钱直接购买,还是使用各种不同的挖矿模式,在获得比特币以后该如何使用它?

先你可以把它当成是一种投资品保存,由于全世界几乎无时无刻都有人在进行比特币交易,因此,它的币值也在不断波动,你可以在它未来价格涨到最高点时脱手卖出,以去年一整年最高的平均价格50多万台币来看,现在一个比特币大约是92 万台币,有可能可以获得大于成本两倍的获利。

如果没有打算将比特币当作保值品来看的话,你可以到币托或是BTCC 等网站里,将获得的比特币转换成新台币,换取现金到现行的银行帐户中供其他使用。如果不想换成新台币的话,也可以将比特币转换成其他Online casino and How to find it 来持有。

此外,目前网路上还有许多网站或服务是支援比特币付款的,以台湾来说,最著名的例子就是「比特台湾交换网」这个网站,它支援买卖家双方使用比特币交换彼此所需的物品,并且可以直接使用比特币付款购买。

其他还有很多网路零售商也支援买家使用比特币在平台上购买商品,国外电子产品零售业龙头之一的newegg 就是其中之一,它们和Bitpay 电子钱包合作,让消费者可以在购买商品时,选择使用比特币进行支付。其他还有像是NASDAQ 的线上百货零售商Overstock、纽约地产公司邦德纽约或是利用信用卡定世界各国旅馆获得比特币现金回馈的PointHound 等等,种类非常多。

As the Bitcoin fever worldwide has not subsided, many Bitcoin users are still mining, whether through team mining or cloud mining. This fever has indirectly led to many problems.

The most direct problem is the graphics card. Since the graphics card is the main mining tool for miners, they need a large number of graphics cards to speed up mining, in order to get Bitcoin before others. This also leads to the fact that whether it is NVIDIA or AMD graphics cards are in short supply worldwide, and it also causes the price of graphics cards to rise, especially the high-end graphics cards are more serious, often requiring to be purchased at a price much higher than the suggested retail price of the manufacturer, making it difficult for consumers who want to buy a graphics card to upgrade their computers.

The mining process is to bring the performance of the graphics card and computer to the extreme. If you can successfully obtain Bitcoin, that is fine, but the worst-case scenario is that you not only fail to mine but also spend extra money. The mining process not only requires maintaining the temperature of the computer host at all times, but also the host needs to be operated in a well-ventilated room to avoid overheating. Under long-term continuous mining, it is also harmful to the lifespan of the graphics card. In addition, the issue of electricity costs must also be considered during the mining process. According to the statistics of the ‘Bitcoin Energy Consumption Index’ report, the total electricity consumption of Bitcoin mining in the past year has reached 29.51 terawatt-hours, accounting for 0.13% of the global total electricity consumption, equivalent to 11.64% of Taiwan’s annual electricity consumption. Although the number may not seem large, this figure has already exceeded the annual electricity consumption of nearly 160 countries in the world, showing the huge electricity consumption of mining. Although Bitcoin indeed has its attractions, miners still need to consider many issues of cost and impact on the way to wealth through mining.

The negative impact of this mining is not only caused by Bitcoin, but also the use of Proof of Work (PoW) mining in Online casinos and How to find it will exacerbate the situation. Therefore, the second largest cryptocurrency, Ethereum, has chosen to transfer the blockchain to a more environmentally friendly Proof of Stake (POS) through merging, thereby reducing the harm to the environment.

The most common risk of Bitcoin mining at present is concentrated on supervision, and in recent years, an increasing number of cities and regions have taken action to ban Bitcoin mining. Therefore, it is recommended to thoroughly study the position of your country on cryptocurrencies and related activities before investing in any Bitcoin mining equipment.

Joining a mining pool does not necessarily mean that you will automatically make a profit. As mentioned before, you must consider the continuous electricity costs, and you can use an online Bitcoin mining calculator to roughly estimate your potential income.

This is the detailed content of the Bitcoin mining tutorial: How to mine Bitcoin? What is a mining machine? How much is the mining cost? For more information about Bitcoin mining, please pay attention to other relevant articles on Script Home!

Declaration: The content of this article does not represent the views and positions of this site, and does not constitute any investment advice of this platform. The content of this article is for reference only, and the risks are borne by the user!

Tag: Mining, Bitcoin