When registering on the Online casino and How to find it trading platform, we are usually required to complete the KYC authentication/identity verification. If the KYC verification is not completed, transactions will be restricted.

The KYC authentication actually has a significant impact on user experience, especially for new entrants to the cryptocurrency market, because they need to provide too much personal identity information, and everyone will worry about the problem of information leakage or illegal use.

KYC (Know Your Customer) is an important concept in the field of finance and compliance, aiming to ensure the authenticity and legality of customer identity through identity verification and background investigation. Specifically, KYC refers to the identification and background investigation of customer identity by financial institutions when establishing business relationships with customers, in order to understand customers and their transaction purposes, actual controllers and beneficial owners of accounts, etc. Through the implementation of KYC, it can effectively detect and report suspicious activities, and is widely used in the field of anti-money laundering,贯穿 throughout various banking business, including marketing and customer acquisition, credit, joint ventures, mergers and acquisitions, etc.

This article will explain why online casino and exchange registration needs KYC real-name authentication, as well as the KYC authentication process and注意事项!

If there are three most hated letters in the cryptocurrency circle and the global banking industry, KYC is definitely one of them. (Note, it’s KYC, not KFC)

The English original of KYC is ‘Know Your Customer’, and the Chinese name is particularly down-to-earth: ‘Know Your Customer’, which can be understood as the meaning of ‘real-name authentication’.

It sounds redundant, who doesn’t know their customers?

But here the KYC is actually more about compliance and anti-money laundering, so KYC is often accompanied by AML (Anti Money Laundering, anti-money laundering).

KYC (Know Your Customer) means ‘Know Your Customer’, and the main reasons for carrying out KYC are as follows 1:

online website sports,We need you

Meeting regulatory requirements: Many countries and regions have strict laws and regulations requiring financial institutions to carry out KYC, such as the USA’s ‘Patriot Act’ and the UK’s ‘Anti-Money Laundering Regulations’. If financial institutions fail to comply, they will face severe penalties such as heavy fines. Combating financial crime: It is an important means to prevent money laundering, terrorist financing and other financial crimes. By verifying customer identity, financial institutions can monitor and detect suspicious transactions, and prevent illegal funds from entering the financial system.

Identifying customer risk: It helps financial institutions fully understand customers’ identity, financial status, business activities and other information, so as to accurately assess the credit risk, market risk, operational risk and other risks that customers may bring in the transaction process. Preventing fraud and identity theft: It can verify the authenticity of customer identity, reduce the occurrence of fraud, and prevent criminals from using false identities to open accounts, defraud or steal customers’ funds and other behaviors.

Improve customer experience: Simplified KYC procedures make it more convenient for customers to conduct business with financial institutions, for example, after customers complete KYC, subsequent transactions can be processed quickly, reducing the trouble caused by issues such as identity verification. Maintain the reputation of the institution: Implementing strict KYC measures indicates that financial institutions are committed to compliant operations and combating financial crime, which helps establish a good corporate image and enhance customer, investor, and market trust in financial institutions. Establish trust in the financial system: From a macro perspective, KYC helps improve the transparency and credibility of the entire financial system, allowing the public to believe that the financial system is safe and reliable, and only legal customers can participate in financial transactions, promoting the healthy and stable development of the financial market.

Prevent cross-border crime: In the context of globalization, the promotion of global KYC standards helps prevent criminals from taking advantage of regulatory differences between different countries and regions to transfer illegal funds across geographical boundaries, strengthen cross-border financial regulatory cooperation and information sharing. Adapt to changes in risk patterns: The methods and forms of financial crime are constantly evolving, and the KYC procedures will be reviewed and updated regularly to help financial institutions respond in a timely manner to new risks and threats, maintaining the ability to prevent financial crime.

Although KYC looks sophisticated, we have all experienced it, especially in the financial field, it is an indispensable part. For example, when you open a bank account, register Alipay, or participate in stock/securities trading, you must submit identity documents, and sometimes you also need to submit proof of home address.

This is the simplest KYC authentication, which is aimed at verifying your identity, preventing the misuse of identity information, and preventing its use in criminal activities!

Similarly, the need for KYC authentication in the world of cryptocurrencies is for this reason, because the natural privacy and anonymity of cryptocurrencies are often used by people with malicious intent for illegal fund-raising, money laundering, selling illegal goods, and so on. In order to eliminate this possibility, under the joint efforts of governments and financial institutions in various countries, the cryptocurrency field also must implement KYC rules.

Currently, all online casino and how to find it exchanges require that account holders need to undergo KYC authentication. The well-known Bitcoin futures contract exchange BitMEX was once sued by the US Department of Justice, including for not requiring users to do KYC.

Recently, Binance announced that all users must complete the intermediate KYC authentication, otherwise they will be prohibited from trading. Looking at the big trend, KYC will be mandatory and will become more and more strict!

General online casino and how to find it exchanges require customers to provide: name, ID card number, front and back photos of the ID card, a photo of the holder of the ID card with handwritten relevant content (ID photo), video or facial recognition, and so on.

KYC real-name recognition and the documents required for your certification

1. Identity authentication documents: ID card, driver’s license, residence permit, passport, and other valid government-issued identity documents.

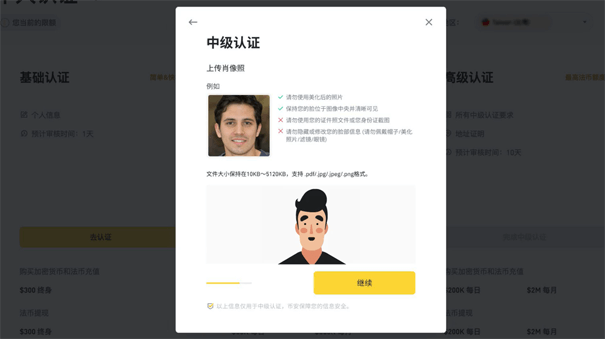

2. Self-portrait/facial recognition: Generally, it is a self-portrait holding a document, or like Binance’s facial photo + facial recognition.

3. Address authentication documents: Generally, it is not more than 3 months of electricity, gas, water bills, or credit card bills, etc. ※(Currently, most Online casino and How to find it exchanges do not require address proof from intermediate-level users).

Points to note for KYC verification

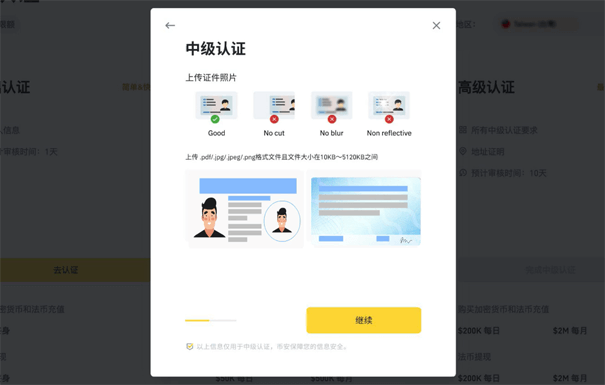

1. The documents provided, whether it is an ID card or proof of address, must pay attention to the integrity and clarity of the photos.sports betting victoryClick to enter

2. When providing ID photos (a photo of the person with the document), pay attention to whether the text of the document is clear and whether the person’s face is fully exposed when taking the photo.

The following takes Binance, the world’s largest Online casino and How to find it exchange, as an example, and the KYC certification process is as follows:

Before real-name authentication, you need to prepare your ID card, and if everything goes smoothly, it will take about 15 minutes to complete.

Log in to your Binance account, then click the head [User Center] – [Identity Verification].

Here, you can see three levels of certification, basic certification, intermediate certification, and advanced certification, as well as the limits of each level. Click [Go to Certification] to enter the certification process.

Currently, Binance requires all customers to complete the intermediate certification, which is very simple and can meet the needs of most users!

A total of three things need to be done: take three photos, download the Binance APP, and facial recognition.

1. Take three photos and upload them

① Front photo of ID card ② Back photo of ID card ③ Self-portrait, showing the upper body, the portrait must be clear

2. Download the Binance APP and complete the facial verification

You can also open the Binance App and complete the facial recognition process by scanning the QR code. Follow Binance’s prompts to complete the verification.

It takes about ten minutes to submit information for review, the system will conduct the review, and send the review results to your email. Please check your email. If you have any questions, you can consult Binance customer service!

Finally, due to the requirement of KYC, if you encounter a fraudulent platform or a black platform, your personal information may be illegally used. To ensure safety, it is recommended to choose a large exchange with good reputation before investing in Online casino and How to find it.

Binance and OKEX are both large trading platforms with high industry recognition.

Declaration: The content of this article does not represent the views and positions of this site, and does not constitute any investment advice of this platform. The content of this article is for reference only, and the risks are borne by the user!

Tag: KYC Real-name Verification