In the past two years, the central bank has been promoting the digital RMB, and many apps have joined in the promotion of digital RMB, launching a multitude of promotional activities. However, many people still do not know how to use it, so here is a bit of popular science to help.

1. What is digital RMB.

Currency. Classification 1: fiat currency and non-fiat currency. Classification 2: paper money and electronic currency. We will focus on electronic currency. Electronic currency includes fiat currency and non-fiat currency. The fiat currency in electronic currency is actually the electronic form of fiat currency, which we use in daily online banking and mobile payments. In addition, the fiat currency in electronic currency includes lottery and How to find it (digital RMB) and so on. The non-fiat currency in electronic currency includes Online casino and How to find it (such as Q coins), lottery and How to find it (such as cryptocurrencies), and so on.

The development of payment methods: paper money, card payment, online banking/electronic banking, mobile payment (scan code, facial recognition, NFC, etc.). The latter two are electronic payments.

sports betting platform and The most exciting gameplay

Electronic payments include online banking, mobile banking apps of various banks, Cloud Flash Payment, digital RMB, Alipay, WeChat, and so onsports betting method and Latest Address. The online banking of major banks (which used to be on PC websites) and mobile banking (mobile apps) and lottery and How to find it are not third-party payment platforms. Platforms like Alipay, WeChat, Douyin Pay, Meituan Pay, which do not have a bank or central bank background, are generally called third-party payment platforms. Why are they called third-party payment platforms? Because our initial transactions were all done through our own accounts and the other party’s accounts, which is a two-party payment. Later, with the development of e-commerce, third-party payment platforms like Alipay and WeChat emerged. Party A (the first party) and Party B (the second party) trade, with the money from Party A’s account first transferred to the third party (Alipay, WeChat), and then transferred to Party B after receiving the goods. Generally, when we use third-party payments, we need to bind a bank card, so the money withdrawn from the bank card is first transferred to the third-party platform, and then the third-party platform transfers the money to the other party’s bank account.

Having talked so much, there may still be doubts about the difference between digital RMB and Alipay, WeChat Pay, and other third-party payment methods? Both are mobile payments and electronic currency forms, so in daily use, they feel quite similar, and it can only be said that digital RMB is just another way of mobile payment (which also determines the difficulty of promoting digital RMB in the face of prosperous third-party payments. Everyone thinks that WeChat Pay and Alipay are enough, and there is no need to develop another digital RMB). However, in essence, they are still different. Digital RMB is just the complete electronic form of paper money, exactly the same as paper money, but the form has changed to digital form and mobile app form. The payment method is still a two-party form. Alipay, WeChat Pay, and others are still in the form of third-party payment platforms. Digital RMB cannot be used for topping up, while Alipay and WeChat Pay can use savings cards and credit cards. Digital RMB is the digitalization of the RMB and a supplement to the electronic payment method.

You can completely treat the digital RMB app as an entity wallet. How to use the entity wallet, the digital RMB app is also how to use it. When using the entity wallet, you must put money into it first, and then use it. The digital RMB app is also like this, you need to recharge money into it.

It is because of the difficulty of promotion that the central bank uses its official advantages and promotes with real gold, which is why there are so many promotional activities. This approach is the same as the promotion of Yunsuanfu at that time.

2. How to use digital RMB.

2a. Firstly, download the digital RMB app. This app is equivalent to the master of our wallet. Register an account with your phone number.

2b. Secondly, open a wallet in the digital RMB app, the wallet is provided by different banks. Different bank wallets can be opened.

2c. Then, go to Wallet Management -> Quick Payment Management -> Open the app that uses digital RMB, such as Meituanonline and Just click to enter. Note that only when the quick payment of the Meituan app is opened, can you select digital RMB for payment when paying on Meituan. If you want to bring up digital RMB payment when paying in an app, you must open quick payment for that app in the digital RMB app.

2d. Finally, place an order and pay on Meituan, and select digital RMB payment. Ensure that there is enough money in digital RMB, otherwise the payment will fail.

3. Other matters in digital RMB

Opening a wallet of a certain bank does not require holding a bank card of that bank. Recharging the wallet does not necessarily require using the bank card of that bank to recharge. The wallet can be canceled and reopened. The wallet reopened is a new wallet, which is not the same as the canceled wallet.

Digital wallet and hardware wallet. The Digital RMB app can not only open a wallet but also bind a hardware walletonline lottery online online casino and Latest. The hardware wallet is an entity card similar to a bus card. If the offline merchant supports the swipe of the hardware wallet, then the hardware wallet entity card can be used for swipingsports betting victory and Latest Address. When paying with digital RMB, you can use the digital wallet or the bound hardware wallet.

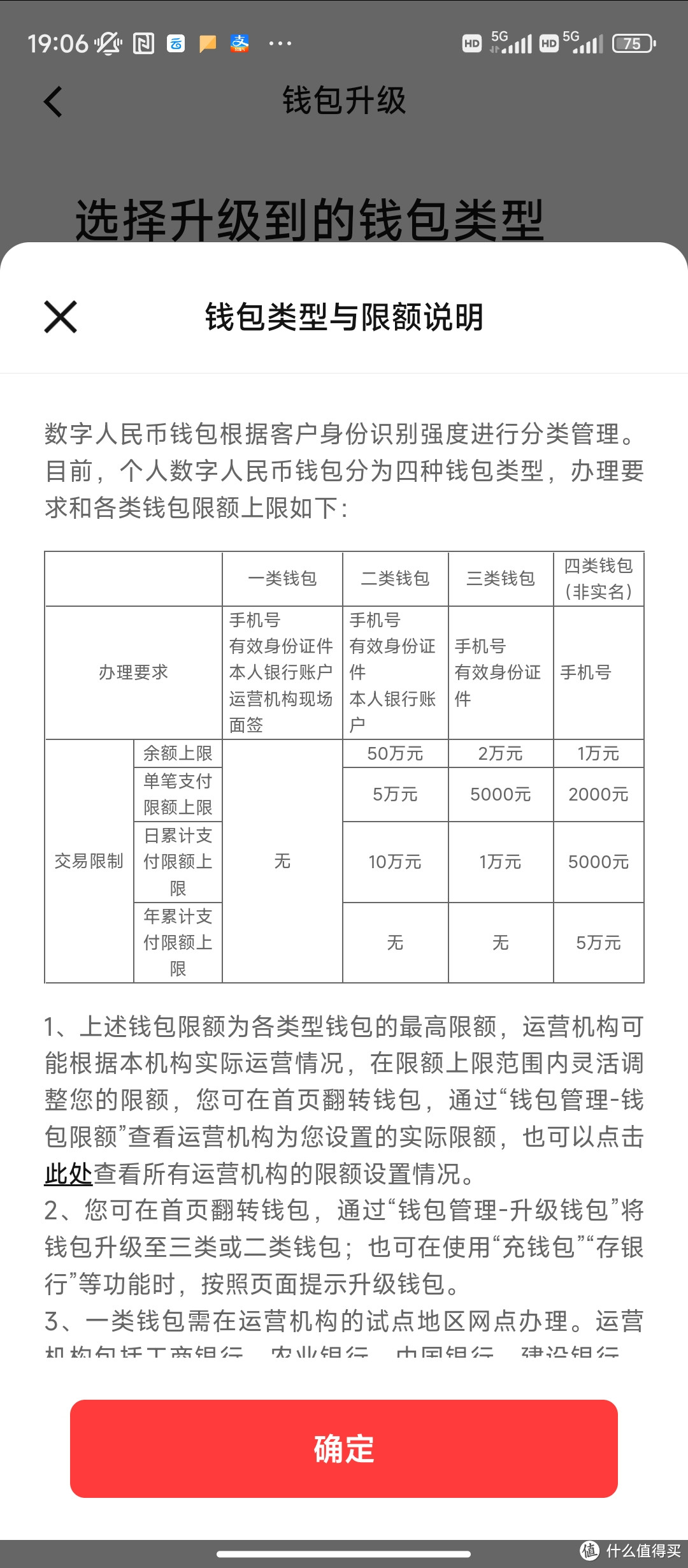

The digital wallet is also divided into four types.

How to recharge the wallet, 1. Recharge using your own bank app on your phone. 2. Recharge using the bank card bound to the wallet. 3. It can also be transferred from other wallets.

The author declares that this article has no conflict of interest, welcome to reasonable communication and harmonious discussion~